Real Clients

Real Results

Proven Fundraising Impact

Pitch Decks

Ready to Join the Ranks of Elite Fundraisers?

Pitch Decks

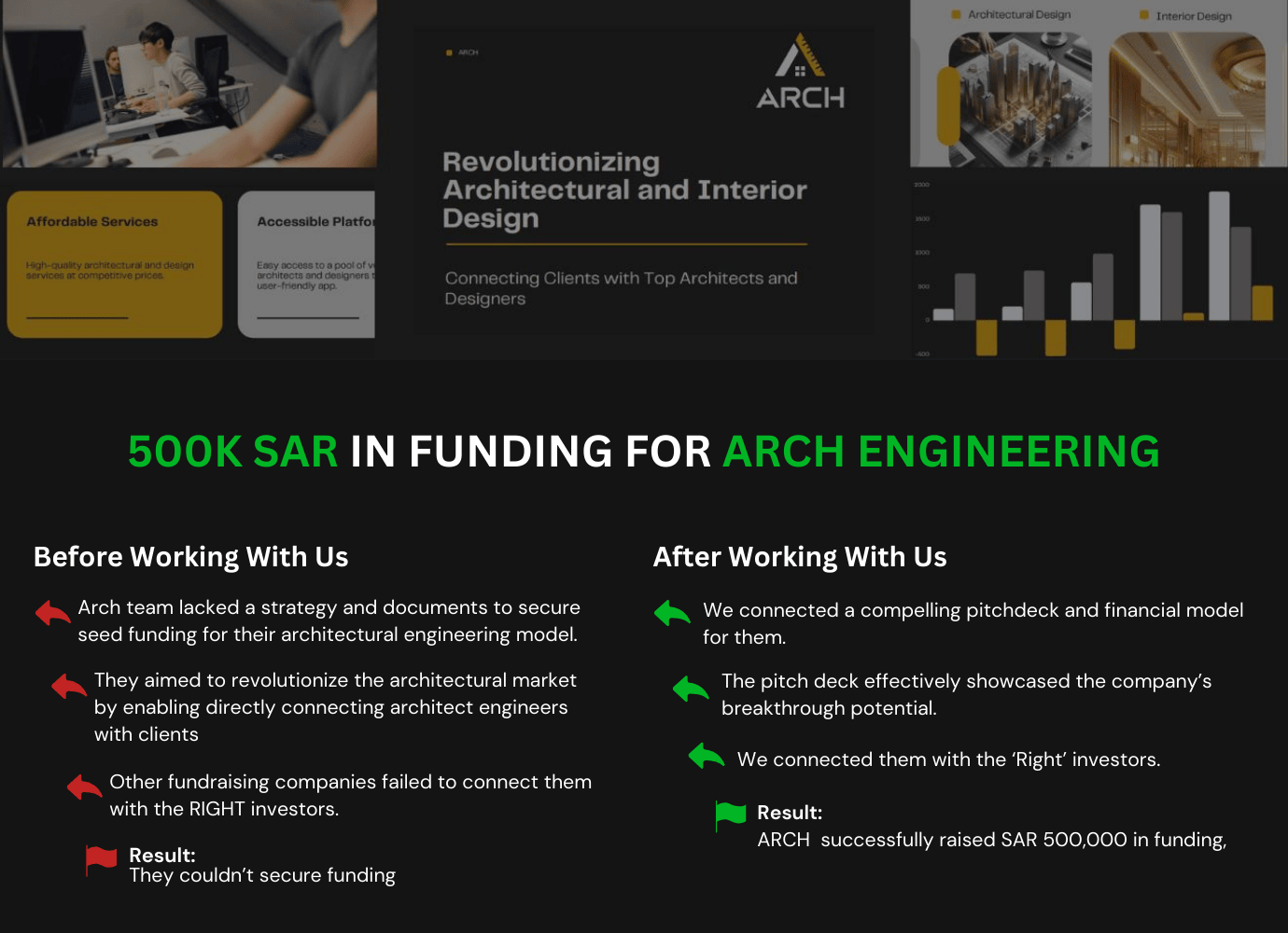

500K SAR IN FUNDING FOR ARCH ENGINEERING

Before Working With Us

Arch team lacked a strategy and documents to secure seed funding for their architectural engineering model.

They aimed to revolutionize the architectural market by enabling directly connecting architect engineers with clients

Other fundraising companies failed to connect them with the RIGHT investors.

Result

They were struggling to secure funding.

After Working With Us

We prepared a compelling pitchdeck and financial model for them.

The pitch deck effectively showcased the company’s breakthrough potential.

We connected them with the ‘Right’ investors.

Result

ARCH successfully raised SAR 500,000 in funding,

Ready to Join the Ranks of Elite Fundraisers?

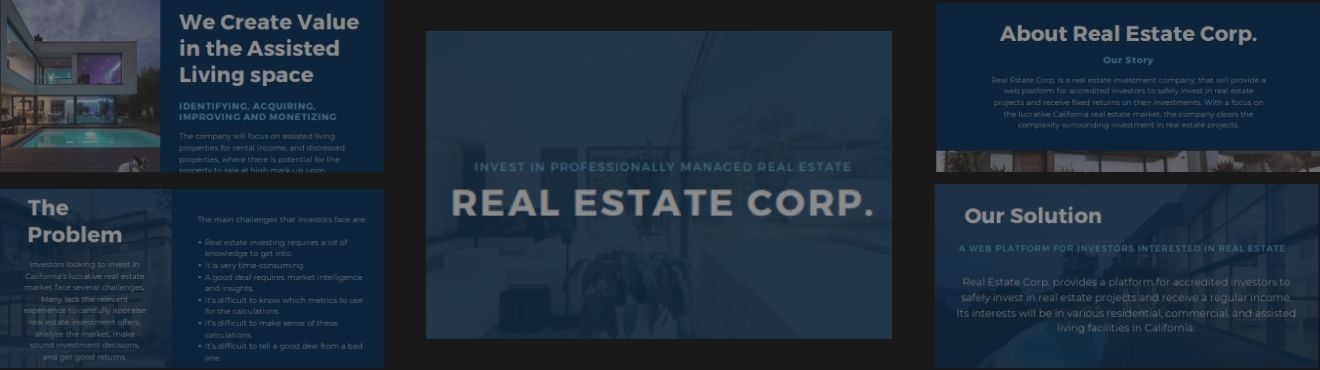

$1M IN FUNDING FOR REAL ESTATE

Before Working With Us

Kevin Real Estate Corp. was planning a large mixed-use development project in British Columbia.

They didn’t know how to reach out to the right investors and where to find them.

Their outreach strategy failed to captivate investors resulting in rejections after rejections.

Result

They failed to secure the funding needed to scale and to acquire new properties.

After Working With Us

They took meetings with the RIGHT investors we set up for them.

Their pitch deck showcased the breakthrough potential of the real estate project.

Result

Thanks to our 1-1 coaching and support throughout the process they closed the funding round and raised $1M

Ready to Join the Ranks of Elite Fundraisers?

Business Plans

Ready to Join the Ranks of Elite Fundraisers?

Business Plans

$5M IN FUNDING FOR UNITED PAYDAY LOAD

Before Working With Us

United Payday Loan failed to secure investor funds due to an unconvincing business plan.

Their outreach strategy failed to grab attention of the RIGHT investors.

They were unable to secure the funding needed to bring their platform to market.

The increasing competition in market led to burnout for United Pay Day Loan owners.

After Working With Us

We helped United Payday create a clear and compelling business plan that effectively showcased why their startup is on the verge of a breakthrough

The business plan effectively showcased the company’s breakthrough potential.

Result

We connected them with the RIGHT investors and they successfully raised $5M in funding.

Ready to Join the Ranks of Elite Fundraisers?

$150K IN FUNDING FOR SHARED WORKSPACE

Before Working With Us

Boofs failed to secure investor funds due to an unconvincing business plan.

Other Fundraising companies failed to connect them with RIGHT investors.

Their value proposition wasn’t clearly communicated.

This failure put their vision of a top tier shared workspace platform at risk.

After Working With Us

We helped Boofs create a clear and compelling business plan.

We utilized our breakthrough S.C.A.L.E fundraising system to create an impactful pitchdeck.

This funding allowed them to scale their business and bring their platform to market.

Result

They successfully raised $150k in funding.

Ready to Join the Ranks of Elite Fundraisers?

Financial Feasibilities

Ready to Join the Ranks of Elite Fundraisers?

Financial Feasibilities

FINANCIAL FEASIBILITY FOR POOCHLES INDIA

Before Working With Us

Poochles struggled to create realistic and scalable financial models for their operations.

They faced issues with:

- Inaccurate revenue projections due to unclear understanding of market dynamics and sales cycles.

- Poorly structured cost analysis, which resulted in unexpected financial strain.

After Working With Us

We helped Poochles in designing a dynamic revenue forecasts based on clear, data-driven market analysis.

We did scenario testing for them, breaking down fixed and variable costs to provide better control over expenditures.

Result

Poochles saw improved financial control and increase in operational efficiency.

Ready to Join the Ranks of Elite Fundraisers?

FINANCIAL MODEL FOR SALARY COACH

Before Working With Us

Salary Coach, an EdTech company, struggled to create a clear financial roadmap for scaling their platform.

They faced challenges such as:

- Unclear revenue projections, leading to confusion about pricing strategies and market entry.

- Lack of scenario-based planning, making it difficult to assess risks and opportunities in different market conditions.

- Inconsistent cost estimates, leading to uncertainty around operational expenses and profitability.

- Limited financial visibility, preventing them from making data-driven decisions for growth and expansion.

After Working With Us

We helped Salary Coach build a dynamic financial model with multiple scenarios and estimates, offering them:

- Realistic revenue projections, customized for various pricing strategies and market conditions.

- Scenario-based financial planning, including best-case, worst-case, and most likely scenarios, allowing for informed risk management.

Result

Salary Coach gained strategic financial clarity, improving decision-making and preparing them for scalable growth.

Ready to Join the Ranks of Elite Fundraisers?

INVESTOR MODEL FOR ASIA PAK

Before Working With Us

Asia Pak, in its acquisition of Lotte Chemicals, needed a comprehensive buyer-side valuation to make informed investment decisions.

They faced issues with:

- Unclear valuation metrics, making it difficult to assess the fair acquisition price.

- Lack of scenario-based modeling, limiting their ability to compare different financial outlooks.

- Uncertainty in future cash flows, affecting risk assessment and strategic planning.

- Absence of a structured valuation approach, leading to inconsistencies in financial forecasts.

After Working With Us

We developed a detailed financial model tailored for Asia Pak, incorporating both management case and buyer case scenarios.

Our approach provided:

- Discounted Cash Flow (DCF) valuation, with a terminal value based on a multiples approach.

- Comparable company analysis, offering a benchmark against industry standards.

- Scenario-based financial insights, allowing Asia Pak to evaluate different strategic possibilities effectively.

Result

Asia Pak gained clarity, confidence, and precision in their acquisition strategy, strengthening their investment decision-making process.

Ready to Join the Ranks of Elite Fundraisers?

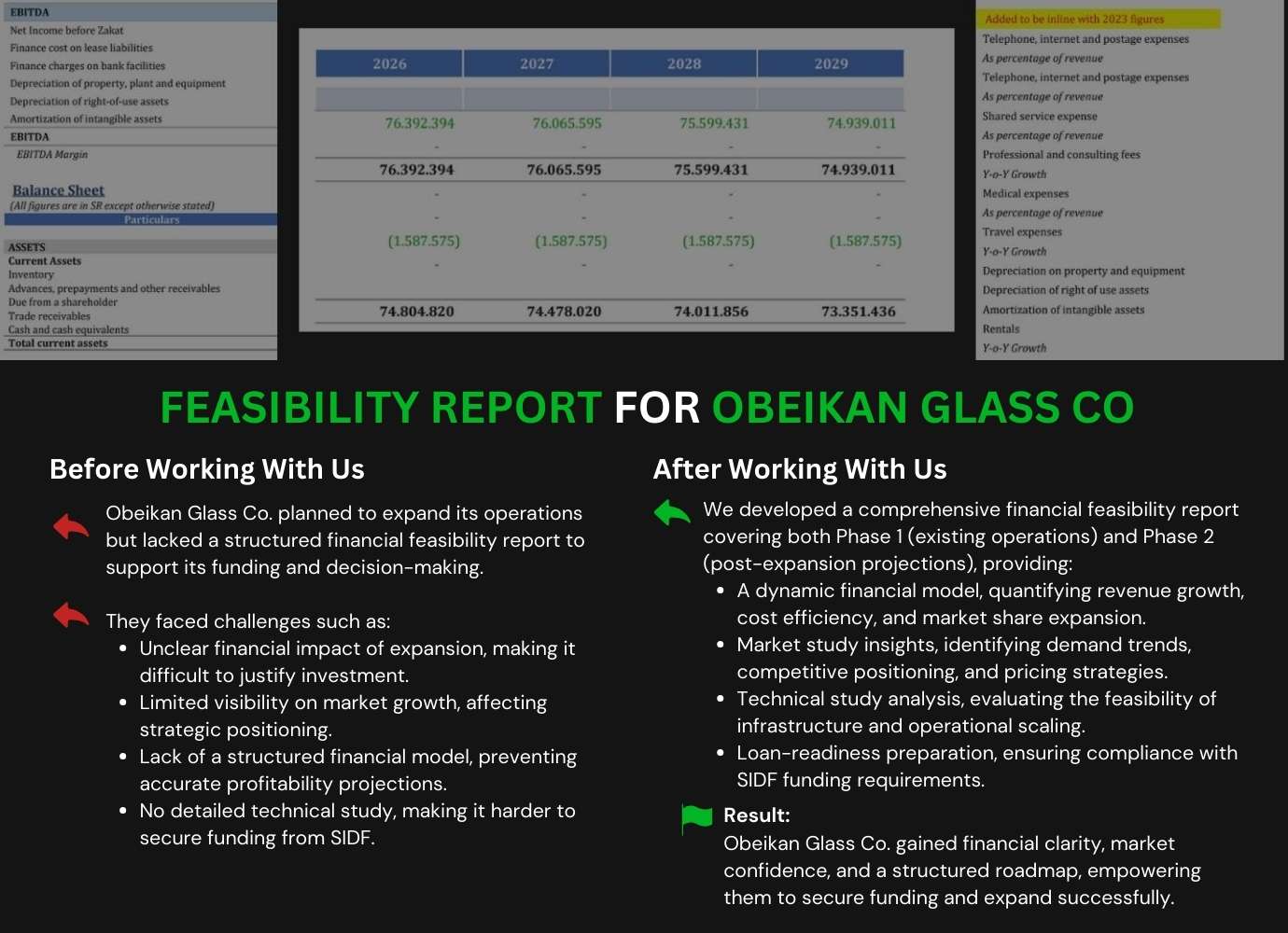

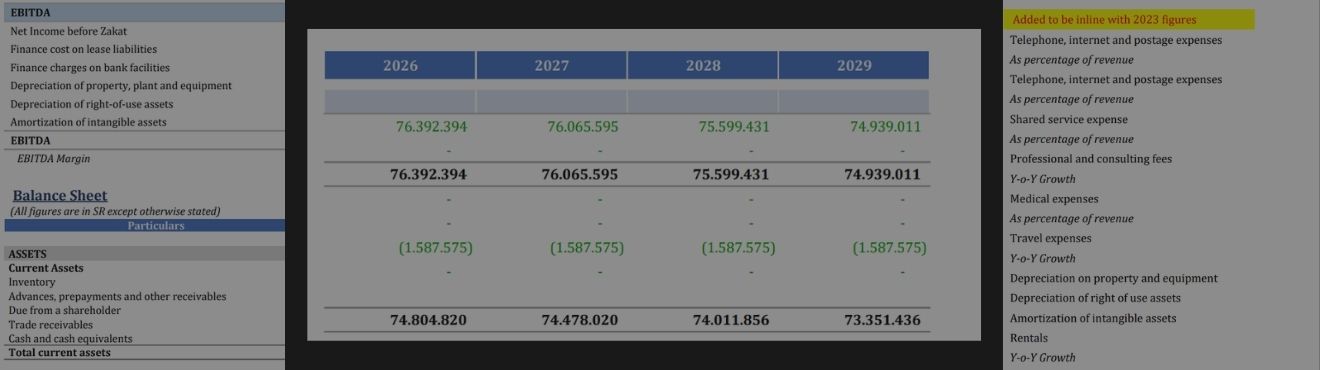

FEASIBILITY REPORT FOR OBEIKAN GLASS CO

Before Working With Us

Obeikan Glass Co. planned to expand its operations but lacked a structured financial feasibility report to support its funding and decision-making.

They faced challenges such as:

- Unclear financial impact of expansion, making it difficult to justify investment.

- Limited visibility on market growth, affecting strategic positioning.

- Lack of a structured financial model, preventing accurate profitability projections.

- No detailed technical study, making it harder to secure funding from SIDF.

After Working With Us

We developed a comprehensive financial feasibility report covering both Phase 1 (existing operations) and Phase 2 (post-expansion projections), providing:

- A dynamic financial model, quantifying revenue growth, cost efficiency, and market share expansion.

- Market study insights, identifying demand trends, competitive positioning, and pricing strategies.

- Technical study analysis, evaluating the feasibility of infrastructure and operational scaling.

- Loan-readiness preparation, ensuring compliance with SIDF funding requirements.

Result

Obeikan Glass Co. gained financial clarity, market confidence, and a structured roadmap, empowering them to secure funding and expand successfully.

Ready to Join the Ranks of Elite Fundraisers?

FAQS

How do we begin working together?

We begin with an initial call to understand your goals and funding needs. From there, we guide you through our onboarding process and build a customized fundraising plan for your company.

What is a pitch deck?

A pitch deck is a clear and visual presentation that showcases your company and its potential to investors. It helps capture their attention quickly and secure valuable meetings.

How do you help companies secure funding?

We develop an investor-ready pitch deck, identify and connect company owners with the right investors, and coach them through outreach, negotiations, and closing. Our clients get expert support at every stage of the process.

Why is Investor Outreach and securing the right meetings so critical?

Investor outreach builds credibility and directly impacts the ability to raise capital. A targeted, well-structured outreach strategy connects you with the right investors and drives stronger engagement.

How is your pitch deck approach different from other agencies?

Each deck is built from scratch to showcase the company’s unique value and growth potential. Our process also applies deep investor psychology insights to ensure the deck resonates with the right investors.

How long does it take to complete a fundraising project?

Most of our clients complete their fundraising round within 90 days. Timelines depend on company readiness and investor feedback, but we structure our process to move efficiently while maintaining quality and precision.

Let’s Write Your Case Study Next

Whether you’re raising capital, validating a project, or building a financial model—we’ll help you do it right.