A letter of employment is a short, signed statement from your employer confirming your job title, start date, income, and employment status.

In Canada, it has become the go-to proof for lenders, landlords, and even some immigration streams because it verifies that you can meet future payment obligations.

Why lenders (and others) want one in 2025

Canada’s mortgage underwriters, led by CMHC, now cross-check a borrower’s income on every high-ratio mortgage file. That scrutiny trickles down to car-loan brokers, credit-card issuers, and large landlords. The easiest single document to meet those new guidelines is—yes—the letter of employment.

Do I need this for a mortgage? Almost always. Is a pay stub enough? Not if the loan exceeds $50,000 or the term exceeds 12 months.

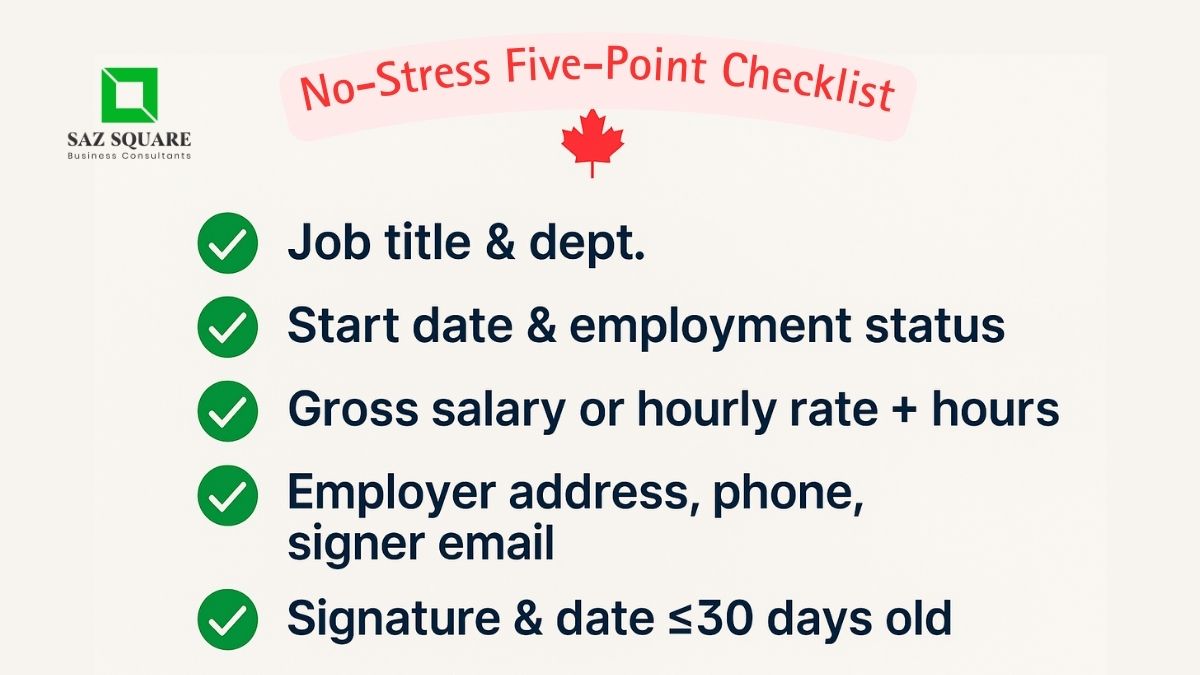

What Canadian lenders need to see (checklist)

| Must-include field | Why it matters | Common snag |

| Job title & department | Confirms role stability | Title doesn’t match LinkedIn |

| Start date & employment status (full-time/part-tim /contract) | Tenure affects risk scoring | Still on probation |

| Gross salary or hourly rate plus average hours | Verifies ability to service debt | Overtime not explained |

| Employer’s address, phone number & signer’s email | Allows lender to phone verify | Uses generic HR inbox |

| Signature & date (≤ 30 days old) | Satisfies “freshness” rule | Photocopied signature |

Regulation watch: CMHC and private insurers follow the “30-day freshness” rule; letters older than a month almost always trigger a re-request.

Who can sign—and what if you’re not a salaried employee?

- Employees: HR manager or direct supervisor on company letterhead.

- Commission / seasonal workers: Attach the last two T4 slips or Notices of Assessment (NOA) alongside the letter.

- Self-employed Canadians: Use a CPA-signed income letter plus the two most recent NOAs—then point lenders to our primer on Line 15000 of the Canadian tax return for context.

Remote staff employed by U.S. or EU firms can still request a Canadian-formatted letter; lenders merely add a currency-conversion step.

Formatting rules nobody tells you

- Business-letter format: 1-inch margins, 11- or 12-pt font, left-aligned.

- Official letterhead: digital letterhead PDF is fine—no Word docs.

- Bilingual clause in Québec: Include a one-sentence French translation or provide a separate page.

- Direct phone number: switchboard numbers, stall verifications.

- Digital signature: Accepted if verifiable; DocuSign or Adobe Sign preferred.

Letter of Employment vs. Job-Offer Letter vs. Reference Letter

| Document | Purpose | Typical length | Used for |

| Letter of employment | Confirms current job & income | 1 page | Loans, rentals, immigration |

| Job-offer letter | Extends future employment offer | 1-3 page | Work permits, visa files |

| Employment reference letter | Describes performance/skills | 1-2 page | New jobs, grad school |

A job offer letter meaning and template often pop up on Google, but lenders rarely accept them because they don’t prove current income.

Digital income verification is coming

The CRA and Employment & Social Development Canada are piloting a secure data-sharing portal that lets approved lenders verify income in real time—no PDF required. Roll-out began in selected provinces in February 2025.

Furthermore, services such as Truework and Certn already offer similar API-based checks, and OSFI’s 2024 integrity guideline encourages federally regulated banks to adopt them.

Takeaway: even if you use a digital verifier, most lenders will still request a traditional letter for audit purposes—so have both ready.

Provincial wrinkles & special cases

Québec: Letters must be bilingual or accompanied by a certified French translation.

Alberta oil-patch contractors: Provide contracts plus a CPA verification because income fluctuates.

Seasonal tourism workers (BC, Atlantic): Add last two NOAs to show average annual income.

International students buying a home with a co-signer: The co-signer’s Canadian letter and the student’s study-permit income proof go together.

For details on cross-border tax status, see our explainer on factual residents of Canada.

Common rejection triggers—and how to dodge them

- Salary on the letter ≠ salary on your T4. Double-check before you send the letter.

- Letterhead cropped or blurry in phone scan. Use a clean PDF.

- Signer’s phone number or e-mail missing. Lenders can’t complete callbacks.

- Letter older than 30 days. Request a fresh copy during mortgage pre-approval, not just at final underwriting.

- Trying to use a job offer letter for a loan > $50,000. Rarely accepted.

Contact us for template guidance, and while you’re there, check our primer on Notice-to-Reader financial statements—often requested alongside self-employed letters.

Before you hit “upload”: quick recap

- Keep the letter of employment under 30 days old.

- Verify every data point against your latest pay stub or NOA.

- Attach extra income proof if you work full time and earn commissions or bonuses.

- Provide a direct HR phone number to avoid processing delays.

- Store a clean PDF copy in a secure cloud folder—you will need it again for car insurance, cell-phone financing, or future property buys.

Final words

A letter of employment might feel like paperwork, but it is your fastest route to buy a home, secure a loan, or even rent a condo in Toronto.

Master the checklist, keep your details consistent, and lenders will approve your file without a hitch—saving you time, stress, and sometimes a full percentage point in interest.

FAQs

How do I get a letter of employment?

Ask HR or your supervisor. Provide them with a template and specify the lender’s required fields so they draft a letter of employment that sails through verification.

Is a letter of employment the same as a job letter?

In everyday Canadian banking, yes. Many lenders use “job letter” as shorthand, but the formal term is letter of employment.

Who writes a letter of employment?

Usually an HR manager. In a small business, the owner or your direct manager can sign—provided they include their job title and contact information.

What is a copy of an employment letter?

A PDF or scanned image of the original signed letter. It must be legible and show the signature and company letterhead clearly.

How to write an employment letter?

Use business-letter format, place employer details at the top, list employment status, start date, income, and include a signer’s signature plus direct contact details. Our free employment letter sample templates cover salaried, hourly, and self-employed scenarios.