Thinking of valuing a mid-market manufacturing firm in Toronto or a SaaS start-up in Vancouver? The Certified Valuation Analyst (CVA) credential—now backed by NACVA’s Canadian chapter (CACVA)—gives professionals the technical depth of U.S. standards plus a pathway that recognises Canada’s CA/CPA licence, remote-proctored testing, and a growing network of local peers.

Here’s what you need to know before committing the time and dollars. 👇

A Certified Valuation Analyst (CVA) is a financial professional credentialed by the National Association of Certified Valuation Analysts (NACVA), signifying recognized expertise in business valuation. CVAs conduct in-depth assessments of company value—using income, market, and asset approaches—for M&A, litigation, tax, estate, and strategic planning.

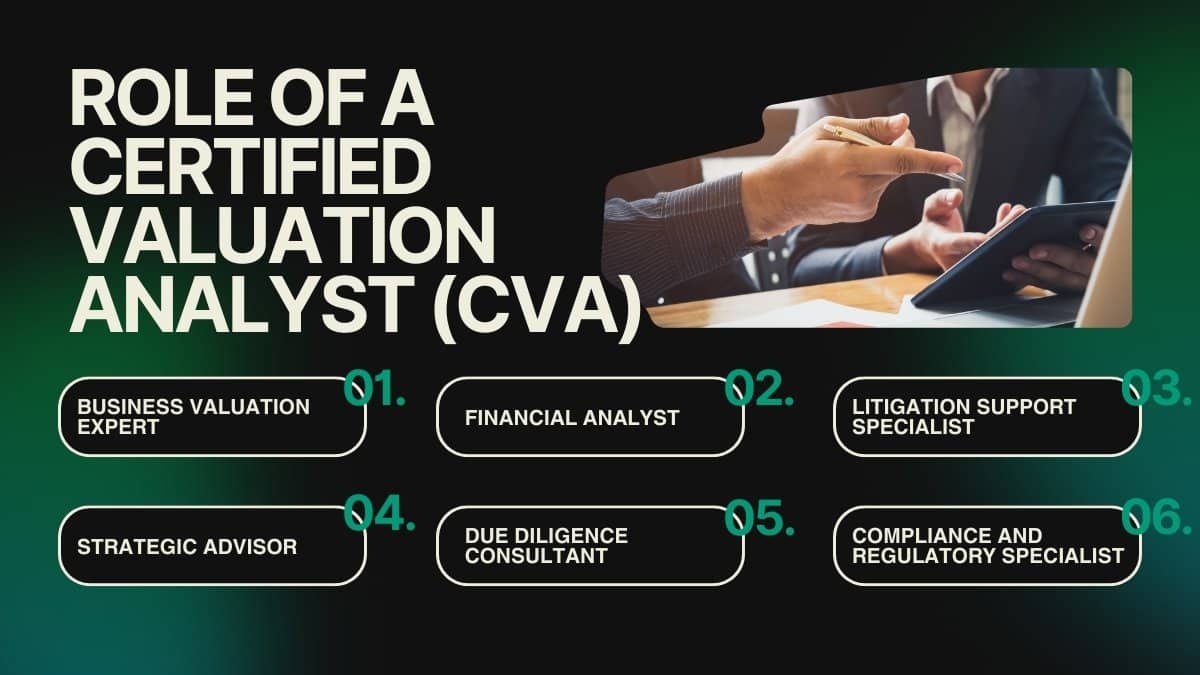

Roles of a Certified Valuation Analyst (CVA)

The primary role of a Certified Valuation Analyst is to conduct detailed business valuations. This involves assessing a business’s worth based on a range of financial data and market conditions. A CVA typically works on several types of valuation, including:

- Financial Reporting Valuations: CVAs enable businesses to accurately report their financial status, ensuring compliance with regulatory requirements. This can involve valuing assets for public financial statements.

- Litigation Support: In legal cases, such as divorce settlements, shareholder disputes, or business dissolution, a CVA provides expert testimony to clarify the valuation of a business.

- Mergers and Acquisitions: CVAs play a critical role in business transactions, helping buyers and sellers understand the fair market value of a company to facilitate negotiations.

- Advisory Roles: Business owners often turn to CVAs for advice on improving company performance or restructuring operations to enhance value.

In short, the CVA designation demonstrates that an individual has the expertise to provide trusted valuations for a variety of business purposes, ensuring decisions are based on objective, well-supported data.

Meanwhile, SAZ SQUARE Business Consultants can assist you in preparing a robust forecast.

How to Become a Certified Valuation Analyst (CVA)

Becoming a Certified Valuation Analyst requires a combination of education, professional experience, and a commitment to ongoing development. Here’s how to pursue this prestigious credential:

1. Education Requirements

Candidates must hold at least a 4‑year bachelor’s degree (BA or BS) from an accredited institution, typically in accounting, finance, economics, or a business-related field. This foundational education ensures a strong grasp of financial principles, accounting methods, and economic theory essential for business valuation.

2. Professional Experience

Applicants are required to complete a minimum of two years of full-time experience in business valuation or related disciplines, such as financial analysis or accounting. This experience must demonstrate proficiency in valuation methodologies and must be validated by a supervisor or professional references.

3. Completing the CVA Exam

The CVA designation requires passing a comprehensive, proctored exam that typically lasts up to five hours. It covers NACVA’s Body of Knowledge, testing both the theoretical understanding and practical application of valuation concepts through multiple-choice and true/false questions.

4. Certification Process

After meeting the education and experience prerequisites, candidates apply to NACVA for exam approval. They submit supporting documentation—such as diplomas, transcripts, and references—pay the required application fee (typically $100), then schedule and pass the proctored exam. Passing the exam grants official CVA credential status.

5. Continuing Education

To maintain CVA certification, designees must earn 60 hours of Continuing Professional Education (CPE) in business valuation, litigation support, financial forensics, or related subjects every three years. These hours can be earned through NACVA-approved courses, webinars, or other qualifying professional education activities

6. Training and Study

NACVA offers comprehensive training programs to help candidates prepare for the CVA exam. These include a five-day Business Valuation: Theory and Practice course, available both in-person and online, along with self-study packages, recorded webinars, and Q&A study guides. This structured training provides both theoretical knowledge and practical skills essential for passing the exam and applying valuation methodologies in real-world scenarios.

7. CVAs for CPAs and Non-CPAs

The CVA certification is open to both CPAs and non-CPAs, though eligibility requirements differ slightly.

For CPAs, an active CPA license, two professional and two business references, and a non-refundable application fee are required.

For non-CPAs, candidates must hold a relevant business degree (such as a bachelor’s or MBA), provide evidence of valuation experience through professional and business references, submit academic transcripts or diplomas, and pay the application fee. Both pathways ensure that candidates possess the necessary background to succeed in business valuation.

8. Work Product Submission

As part of the certification process, candidates must submit a work product for peer review within 60 days of completing the exam. This can be either a sanitized, client-ready valuation report completed within the past 12 months or a case study provided by NACVA. The work product allows NACVA to assess the candidate’s ability to apply valuation theory and produce high-quality valuation reports, serving as a final demonstration of professional competence.

Canadian Pathway & Fees (2025 update)

- CA ≃ CPA shortcut – NACVA recognises the Canadian Chartered Accountant (CA) licence as equivalent to the U.S. CPA, so Canadian CAs can skip extra credential verification.

- $100 USD one-time application fee – unchanged for 2025.

- Remote-proctored testing – sit the 5-hour exam from home or any Kryterion centre; no surcharge.

- Training bundle (optional) – Five-day “Business Valuation: Theory & Practice” course (≈ CA $4,600) awards 45 CPE hours and includes the exam seat.

- Recertification – 60 CPE hours every three years (business valuation or financial forensics).

Note: Fees converted at 1 USD ≈ 1.35 CAD (July 2025).

Benefits of Being a Certified Valuation Analyst (CVA)

Although the CVA credential doesn’t guarantee success, it qualifies you to perform business valuations across multiple industries. It strengthens your credibility and demonstrates your ability to deliver informed, professional analyses.

- Career Advancement: Holding the CVA certification opens up a range of career opportunities. Whether as a business valuation expert or a certified business appraiser, professionals with this credential are highly sought after by law firms, financial institutions, and business owners. This designation can lead to more job offers, higher salaries, and greater job security.

- Increased Credibility: Clients and employers trust the CVA designation as a mark of professional expertise. For business owners, working with a CVA ensures that business valuations are accurate, legally compliant, and free from bias. This boosts credibility in financial transactions, legal disputes, and negotiations.

- Specialized Knowledge: CVAs are trained to evaluate businesses using established and recognized methodologies. The in-depth knowledge gained through NACVA’s certification process provides business owners with insights into their company’s financial health, strategic position, and potential for growth.

- Networking Opportunities: Becoming a Certified Valuation Analyst also means joining a network of professionals within NACVA. This community provides opportunities for collaboration, knowledge sharing, and business development.

- Greater Earning Potential: The CVA designation is a premium qualification, and professionals who hold it tend to command higher fees for their services. Whether working in litigation support or business appraisal, CVAs can charge premium rates due to their specialized skills and expertise.

Earning Outlook in Canada ’25

- Median base pay: CA $53k for Valuation Analysts

- Average total comp: CA $75k (mid-career)

- Current demand: ~ 780 open “valuation analyst”-type roles across Canada on LinkedIn (July 2025).

Ready to leverage the CVA for higher billings? → Talk to our valuation advisors now!

CVA vs Other Valuation Professionals

| Type | Certified Valuation Analyst (CVA) | Certified Public Accountant (CPA) | Chartered Financial Analyst (CFA) | Certified Business Appraiser (CBA) |

|---|---|---|---|---|

| Roles | Specializes in business valuations for various purposes such as financial reporting, mergers, and litigation. | Primarily focuses on accounting, tax preparation, and financial audits, but can also perform business valuations in certain cases. | Focuses on financial analysis, investment management, and portfolio management, with some overlap in valuation in investment contexts. | Specializes in the valuation of businesses, intangible assets, and securities, especially in the context of mergers and acquisitions. |

| Requirements | Requires a bachelor’s degree, 2-3 years of valuation experience, passing the CVA exam, and continuing education. | Requires a bachelor’s degree in accounting, passing the CPA exam, and meeting state-specific licensing requirements. | Requires a bachelor’s degree, passing the CFA exam, and relevant financial experience. | Requires a background in accounting, finance, or business, passing the CBA exam, and continuing education. |

| Key Focus | Business valuation methodologies, litigation support, and mergers and acquisitions. | Broad accounting knowledge with a focus on financial reporting, audits, and tax preparation. | Investment analysis, portfolio management, and financial analysis for investments. | Business valuation for financial reporting, tax compliance, and estate planning. |

| Benefits | In-depth expertise in business valuations, higher earning potential in valuation-focused roles, and increased credibility in legal and financial sectors. | High demand in accounting and finance, regulatory authority, and career flexibility. | Strong focus on investment management, global recognition, and opportunities in finance and asset management. | Strong recognition in the valuation field, especially in mergers, acquisitions, and tax compliance. |

| Applicable Industries | Business, finance, legal, mergers & acquisitions, factual residency, and tax planning. | Accounting, auditing, tax, financial reporting, and consulting. | Investment firms, hedge funds, financial analysis, asset management. | Business valuation for transactions, estate planning, and tax reporting. |

“CVA vs CBV” Cheat-sheet

| Factor | Certified Valuation Analyst (CVA) | Chartered Business Valuator (CBV) |

| Eligibility | Bachelor’s degree + 2 yrs valuation experience (or CPA/CA equivalence) | Bachelor’s degree + completion of 6 CBV courses + 1,500 hrs relevant experience |

| Governing body | NACVA (Canadian chapter: CACVA) | CBV Institute |

| Exam format | 5-hour, 400-question multiple-choice exam, now available via live remote proctoring | 4-hour Membership Qualification Exam (MQE), online once a year |

| Typical 2025 cost (CAD) | US $100 app fee + ≈ CA $4,700 for full 5-day BVTC course & exam package | CA $300 student fee + CA $1,380 MQE fee + CA $950 annual dues |

| 2025 Canadian pass-rate / mark | ~ 85 % pass (15 % fail) | CBV Institute doesn’t publish pass-rate; MQE pass-mark is 60 % |

Conclusion

The Certified Valuation Analyst (CVA) designation is an essential credential for anyone pursuing a career in business valuation. CVAs provide critical insights into a company’s worth, guiding business owners, investors, and legal professionals through complex financial decisions. By obtaining the CVA designation, individuals open doors to higher-level career opportunities, improved earning potential, and a trusted position within the field of business valuation.

FAQs

What are the duties and responsibilities of a Valuation Analyst?

A valuation analyst assesses the financial worth of companies or assets using detailed financial data and market research. They calculate share value, analyze risks, review financial statements, and prepare reports to support mergers, acquisitions, investments, or internal decision-making processes.

How hard is it to get a CVA?

Earning the CVA requires a business degree or CPA, two years’ valuation experience, passing a rigorous five-hour proctored exam (15% average failure), plus a peer-reviewed case study submission.

How much does a CVA make?

As of mid‑2025, Certified Valuation Analysts (CVAs) in the US typically earn between $60,000 – $110,000 per year. ZipRecruiter averages $60,271 / yr.

What do you need to be a CVA?

To become a Certified Valuation Analyst (CVA), you need a bachelor’s degree in business-related fields or a CPA license, plus a valid degree, along with at least two years of valuation experience, successful completion of a peer-reviewed case study or valuation report, and passing a five-hour proctored exam.

How long does it take to become a CVA?

It typically takes 6 to 12 months to earn your CVA—this includes completing any training, gaining required valuation experience, passing the 5-hour proctored exam, and submitting a peer-reviewed case study.

Reddit users note:

“I got a CVA after 2 years of doing business valuation full‑time. It was very easy to attain. One 5‑day class with a test, and one case study report.”