Buying a Canadian company takes nine clear steps: set search criteria, source targets, value them, secure financing, complete due diligence, negotiate structure, clear federal-provincial rules, close, then integrate. Follow this in-depth blog post to buy a business in Canada in six to twelve months (depending on your struggle), even as a foreign buyer.

The playbook below walks you through: where to look, how much to pay, which loan or tax election to use, and what immigration route still works.

I believe it’s important to answer this question before we get started.

Why Entrepreneurs Choose Acquisition Over Start-Up

Canada’s small-firm landscape is aging. 76 percent of owners plan to exit within ten years, putting $2 trillion in assets on the block. Buying means instant customers, cash flow, trained staff, and easier financing than a green-field launch.

Median deals close at four to six times EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) for firms under C$5 million revenue. That ratio often undercuts the cost and risk of starting from scratch.

1. Define Your Ideal Target and Budget

Start with a written profile covering industry, location, revenue, owner hours, and growth upside. Small acquisitions (C$50k – 200k) suit first-time operators. Mid-market deals (C$200k – 1M+) attract investors chasing scale. Decide whether you will run day-to-day or retain management. Banks want buyers to inject 10-40 % equity, so ring-fence cash early.

2. Find Businesses for Sale in Canada

Online canadian marketplaces list hundreds of live deals:

| Channel | Coverage | Typical Asking Price | Comment |

|---|---|---|---|

| BizBuySell Canada | 500+ active listings | C$100k – 5M | Search filter by cash flow |

| Sunbelt Canada | 30 offices | C$250k – 20M | Broker-curated inventory |

| SuccessionMatching & CFIB network | 95,000 SMEs | Various | Good for rural or family firms |

Broker vs DIY—quick compare

- Broker advantages: proprietary deal flow, valuation help, confidentiality.

- DIY advantages: lower fees, direct seller rapport, flexibility.

3. Structuring the Deal

Two formats dominate:

Share Purchase

You obtain the corporation and every liability attached. Buyers keep valuable licences and customer contracts. Sellers favour this route for capital-gains treatment.

Asset Purchase

You cherry-pick equipment, inventory, and goodwill. GST/HST can be deferred if both parties file a joint election on Form 44. The buyer gets a fresh tax depreciation “bump” on assets. However, some licences must be re-issued.

Allocate price among tangible assets and goodwill early; it drives tax burden and lender security.

4. Valuation and Due Diligence

Professional CBV or CPA valuators weigh three methods: income (DCF), market (EBITDA multiples), and asset backing. Canadian small-firm multiples average four to six times EBITDA in 2025.

▶️ Go through our investor-ready documentation checklist to make sure every financial, legal, and market file is audit-proof before you present numbers to lenders.

Due diligence runs four lanes:

- Financial – verify revenue, adjust owner benefits, check GST/HST arrears.

- Legal – lien searches, contracts, employment law.

- Environmental – Phase I ESA costs C$3k – 5k; Phase II can top C$60k.

- Operational – customer concentration, tech stack, key staff.

Budget two months for a complete review.

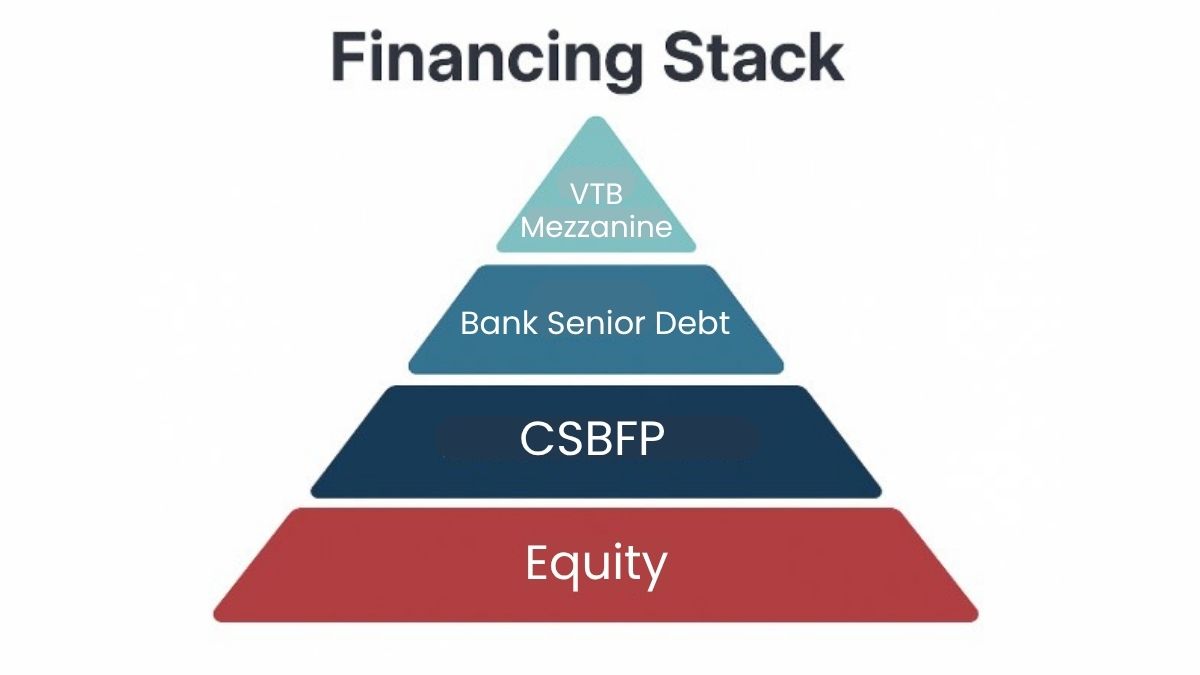

5. Financing the Purchase

Bank and BDC Loans

BDC lends up to 90 % of purchase price if cash flow covers a 1.15 debt-service ratio, usually requiring 10–25 % buyer equity.

Canada Small Business Financing Program

CSBFP backs 90 % of a loan up to C$1M; only C$150 k may cover goodwill and intangibles.

Vendor Take-Back & Earn-Out

Sellers often finance 10–30 % at 5–8 % interest, aligning interests during hand-over.

Private Capital

Angel groups deployed C$1.66 billion since 2010, often preferring convertible notes.

6. Legal, Tax, and Regulatory Hurdles

Investment Canada Act

Direct acquisitions by WTO-private investors trigger a review only if enterprise value exceeds C$1.386 billion in 2025. National-security reviews may still apply regardless of size.

Competition Act Notification

Asset or share deals require pre-merger filing if target assets or revenues exceed C$97 million (2025 threshold).

Provincial Steps

Register the new owner, update licences, and file workplace insurance within thirty days. Corporate tax combines federal 9 % with provincial 0–4 % small-business rate.

7. Immigration Pathways for Foreign Buyers

Foreign entrepreneurs can still buy a business in Canada even after the Owner-Operator LMIA route closed. The cleanest option is the Entrepreneur Work Permit under the Immigration and Refugee Protection Regulations C11 “significant benefit” clause.

You present a sound business plan, prove that your ownership stake exceeds 51 percent, and show how the purchase will add jobs or technology.

Many provinces also run nominee streams that welcome business acquirers who commit capital and meet residency rules. If you already own a parent company abroad, the federal Intra-Company Transfer program lets you relocate as an executive to the Canadian subsidiary you acquire.

All three pathways demand proof of funds, clear corporate documents, and a timeline to begin operating. Processing usually takes four to eight months, so build that window into your deal calendar while you line up financing.

Looking for more details? Read the full guide here.

8. Closing the Deal

Closing formalises every promise you and the seller have discussed. Start with a tightly worded Letter of Intent that grants you exclusivity while you finish due diligence. Once the numbers check out, instruct counsel to draft the Definitive Agreement. That document locks in purchase price, seller representations, escrow terms, a non-compete, and the length of the owner’s post-sale training period. Parallel to the legal drafting, collect bank or BDC commitment letters so funds are ready on signing day.

On closing, you execute either a share or asset transfer, release purchase money through a lawyer-managed trust account, and file provincial registration updates. Share certificates or asset bills of sale then pass to you, and the seller receives cash once all conditions are met.

A disciplined closing sequence like this protects both sides and keeps your plan to buy a business in Canada on schedule. Most closings use a lawyer-run escrow for purchase funds and share certificates.

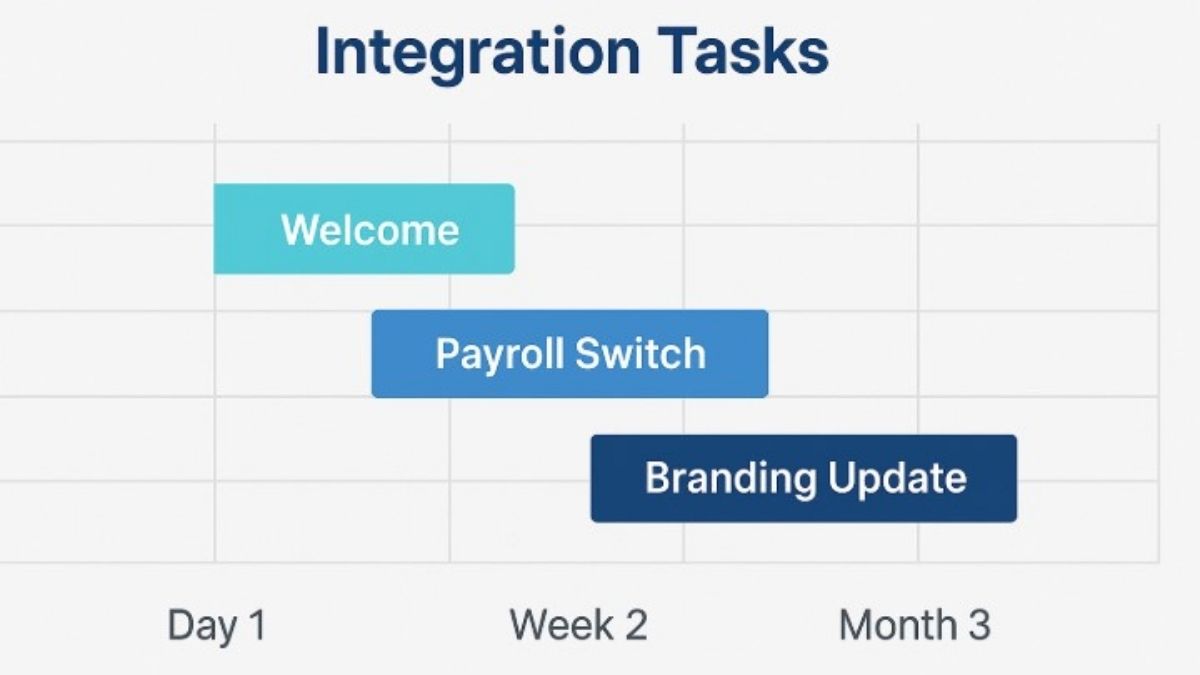

9. Post-Purchase Integration and Growth

The first ninety days decide whether the acquisition delivers its forecast. Meet every employee face to face, review supplier contracts, and move banking authority to the new entity.

Next, build a rolling twelve-month forecast that tracks revenue, gross margin, and debt-service coverage. Align each key performance indicator with specific staff accountabilities so nothing slips.

Refresh branding only after customers feel continuity. A fractional Chief Financial Officer (CFO) can monitor covenants and refine your forecast without the cost of a full-time hire.

These early moves stabilise operations and position the company for organic growth or bolt-on acquisitions.

Common Pitfalls and How to Avoid Them

- Many buyers over-estimate cost synergies. Validate every projected saving during due diligence and adjust the price if numbers fall short.

- Working capital can swing sharply after closing, so negotiate a net working capital target and an adjustment mechanism to avoid disputes.

- Underfunding is another trap. Arrange a ten-percent standby line with your bank to cover surprises such as inventory spikes or equipment failure.

- Another factor to consider is the culture clashes that sink morale fast. Ask the seller for permission to meet key employees before closing and listen to their concerns.

These precautions keep your plan to buy a business in Canada financially sound and operationally smooth.

Resources to Check Out

- CRA Form 44 guide for GST/HST elections.

- CFIB succession marketplace for off-market deals.

Conclusion

You now have a step-by-step map to buy a business in Canada quickly and correctly. Write your search profile, build a deal team, value smartly, fund with the right mix, navigate federal and provincial rules, and then integrate for growth.

Whether you are a local entrepreneur or a foreign investor, Canada’s wave of retiring owners means opportunity is waiting.

FAQs on Buying a Business in Canada

Can a foreigner buy a business in Canada?

Yes, a non-resident can buy a business in Canada through share or asset acquisition, provided the deal passes any required Investment Canada reviews and they secure an owner-operator or entrepreneur work permit.

How much personal equity do lenders expect?

Most banks and BDC deals demand 10 % – 40 % buyer equity to prove commitment before releasing acquisition loans and to keep leverage within safe cash-flow ratios.

Which structure is better — share purchase or asset purchase?

Asset purchases let buyers step up depreciation and sidestep hidden liabilities, while share purchases preserve licences and give sellers capital-gains tax relief.

When does the Investment Canada Act apply?

A direct acquisition by a WTO-private investor triggers a net-benefit review only when enterprise value tops roughly C$1.38 billion in 2025, yet any size deal can face national-security screening.

What loan programs support small-business acquisitions?

The Canada Small Business Financing Program lends up to C$1 million (with just C$150k for goodwill) and BDC offers specialised purchase-or-transfer loans.