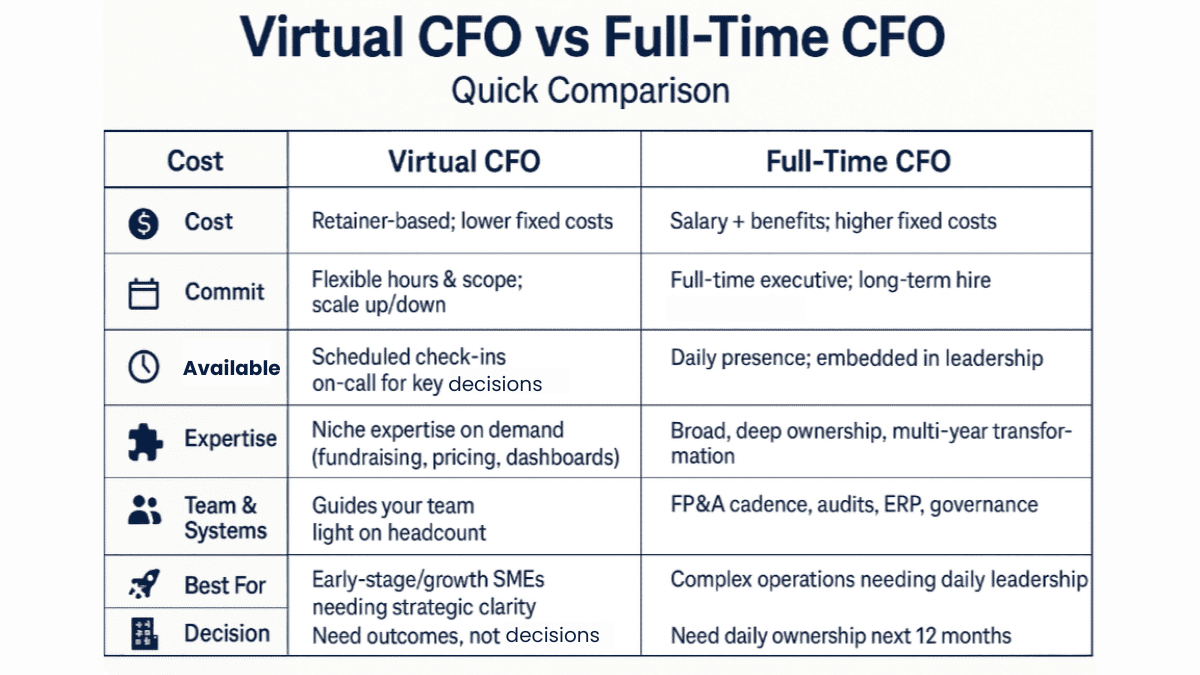

If you want a fast answer to virtual CFO vs full-time CFO, match the option to your stage and budget. Pick a virtual CFO when you need senior finance strategy a few days per month with flexible scope and a lower monthly outlay. Hire a full-time CFO when you need daily executive ownership of finance, people leadership, and long-range capital planning.

In Canada, full-time CFO roles are six-figure hires, while virtual retainers sit in the low-to-mid thousands per month for defined scope. [Working as a CFO | Randstad Canada]

What Is a Virtual CFO?

A virtual CFO is an outsourced CFO who provides senior financial leadership as a service. The work is remote-first, with structured check-ins and clear deliverables. Engagements combine forecasting, cash flow oversight, lender or investor packages, pricing models, and board-ready reporting. Hours scale with need, which fits founder-led teams that want strategic finance without adding a permanent executive. Canadian firms publish transparent tiers that start near two to five thousand dollars per month and expand as the scope widens to forecasting and board reporting. These are service contracts, not payroll hires, which keeps fixed costs light.

Outsourcing finance still requires strong privacy controls. Under Canada’s private-sector privacy law, you remain accountable for personal information processed by service providers. Contracts should set confidentiality, breach notification, and data handling rules, especially if any processing occurs outside Canada. That is why a good virtual CFO engagement includes access controls, defined data flows, and a clear incident response plan aligned with PIPEDA guidance. [Privacy Commissioner Canada]

What Does a Full-Time CFO Do?

A full-time CFO is a named executive who owns strategy through the lens of finance and leads the finance function. The role spans four classic dimensions: steward of controls and reporting, operator of an efficient finance engine, catalyst for change, and strategist who shapes capital allocation and long-term value. This mix is why the position belongs on the leadership table once your company needs daily cross-functional decisions guided by finance. [Four faces of the CFO | Deloitte]

The full-time CFO also builds people and systems. That means designing an operating cadence for FP&A, recruiting controllers and analysts, selecting the tech stack, and leading risk and governance programs. At this level, the CFO partners with the CEO on growth bets and with the board on performance and risk. The payoff is institutional memory and speed across decisions that depend on cash, margin, and returns.

4 Key Differences Between Virtual and Full-Time CFOs

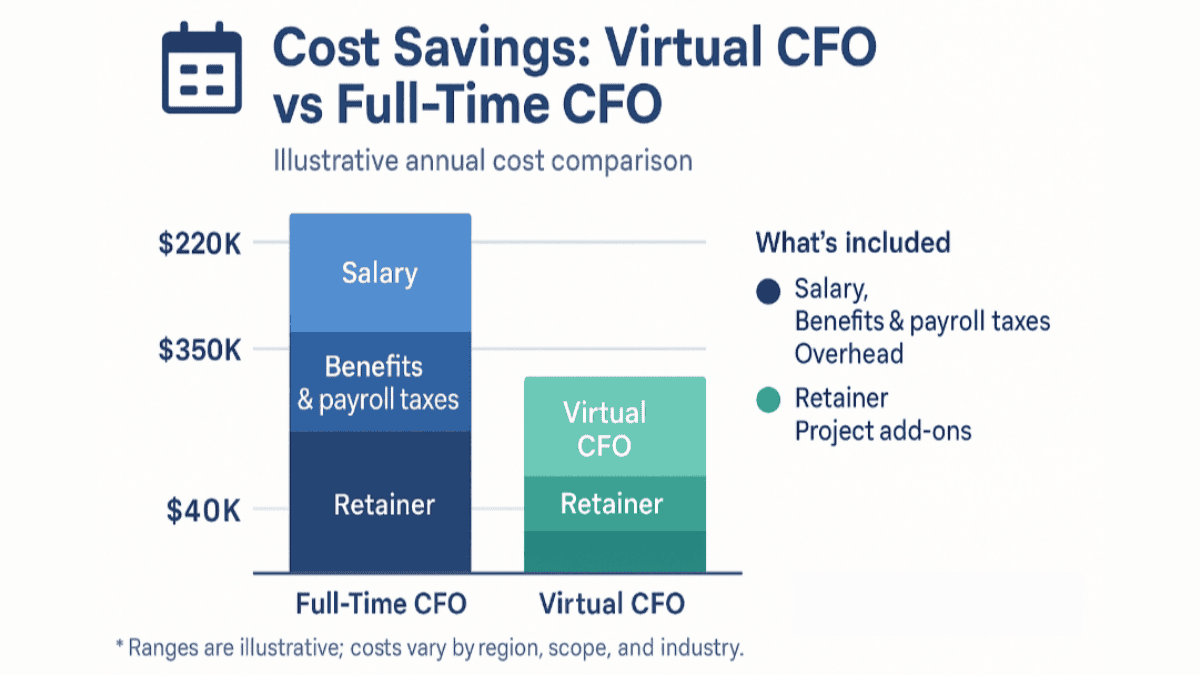

- Cost Comparison. Canadian market data shows CFO salaries commonly sit in six figures, with upper ranges higher for large or complex firms. That base does not equal total employer cost. Benefits, CPP and EI, paid time, incentives, and overhead add to the bill. Advisory tools from QuickBooks outline these added items to help calculate true cost per employee hour. A virtual or fractional CFO avoids those fixed costs and is billed as a retainer or defined project. This is why early-stage companies often start with virtual and revisit a full-time hire at scale.

- Flexibility and Accessibility. A virtual CFO engagement can start fast and scale up or down after funding rounds, product launches, or seasonal spikes. Availability is scheduled, yet many firms include rapid support for critical decisions. A full-time CFO is present every day and is embedded in leadership rhythms, which improves alignment on pricing, hiring, and capital decisions that shift week to week.

- Expertise and Scalability. Virtual models give you immediate access to niche expertise, like fundraising prep, data-driven pricing, or SaaS metrics, without a permanent headcount. A full-time CFO creates depth inside the company, builds succession, and owns multi-year change programs, such as ERP upgrades and multi-entity consolidation. The choice is about time horizon and how much of your financial leadership must live inside the walls.

- Commitment and Involvement. Virtual contracts define scope, service levels, and outcomes. That clarity suits founders who want results without expanding payroll. A full-time CFO is accountable for people leadership and performance every day and becomes a culture carrier for how the company plans, invests, and measures value. The trade-off is clear: elasticity versus embedded ownership.

Pros and Cons of Each Model

A virtual CFO keeps costs elastic and focuses attention on the work that moves the needle now. You can stand up rolling forecasts, lender packages, and board packs quickly, then dial the engagement as needs change. This model works best when the goal is clarity and momentum, not a wholesale re-architecture of finance. The risk is limited hours and the need for tight inputs from your team to keep cycles on time. Canadian businesses must also ensure the right privacy provisions are in place with any outsourced CFO or remote CFO partner.

A full-time CFO delivers continuity, internal talent development, and faster cross-functional execution. Large transaction volumes, audits, and transformation programs benefit from that daily leadership. The cost is higher and includes recruiting, ramp time, and ongoing compensation. That is why many founders decide on a staged path: start virtual, prove value, then convert when scale and complexity justify the seat.

When to Choose a Virtual CFO

Choose virtual if your biggest pain is visibility and decision support, not day-to-day executive management. If you need a 13-week cash view, a driver-based forecast, investor or lender materials, and monthly board-ready reporting, a virtual CFO can deliver those quickly and economically. Current Canadian examples show tiered retainers starting around two to five thousand dollars per month for growth-stage needs, with scope for modeling and strategic reporting at higher tiers. For a sprint, advisers in Canada quote packages that bundle assessment, forecast builds, and investor-ready materials with clear deliverables and timelines. This structure is ideal for run-rate planning, cash runway modeling, and pricing model resets that benefit from short, senior bursts.

This approach also pairs well with today’s finance stack. Many teams now use AI copilots for spreadsheet modeling, anomaly prompts in close tasks, and real-time dashboards for burn and payback visibility. A virtual CFO supervises that stack, sets governance, and trains your team on a reporting rhythm that speeds monthly decisions. For founder-led and agency businesses, this keeps finance strategic while staying lean.

👉 For a clear view of scope, deliverables, and pricing, check out our post on Fractional CFO services in Canada.

When to Choose a Full-Time CFO

Choose full-time when you need daily leadership and internal capacity growth. If you are running multi-entity operations, planning acquisitions, or rebuilding the finance function, you will want an executive who owns people, processes, and performance. The CFO will stand up a durable operating model for FP&A and controllership and will drive change programs that require constant coordination.

Budget matters here. Canadian salary references show meaningful six-figure bases for CFO roles, with higher pay in larger markets and complex industries. Employers should budget beyond base to include variable compensation, benefits, and overhead. Tools from QuickBooks help teams calculate the true cost of an employee beyond gross wages, which helps compare permanent hires with service contracts on an apples-to-apples basis. When the math still supports the hire and the scope demands daily ownership, the full-time path is right.

Which Option Works Best for You?

Bring your decision back to needs, budget, and time horizon. If your immediate need is strategic clarity with defined outputs and you want to keep payroll light, virtual fits. If your need is ongoing transformation with complex risk and team building, go full-time.

➡️ If you want a fuller picture of how outsourced leadership works in practice, read what a CFO advisory firm does and how it supports growth.

Use a simple test: do you need executive involvement every single day for the next twelve months. If yes, a permanent CFO is the safer move. If not, a virtual engagement can deliver focus and results, then scale with you. That is the practical way to resolve virtual CFO vs full-time CFO for a Canadian SME evaluating the next finance step.

Conclusion

If you are ready to pilot a lean model, start with a 90-day finance clarity sprint that includes a 13-week cash view, driver-based forecast, KPI dashboard, and a board-ready performance pack. If you prefer a deeper commitment, plan a full-time CFO search with a clear role scorecard and an internal cadence for FP&A, close, and governance. For either path, book a consult with CFO Advisory at SAZ SQUARE to scope your first quarter of work, set measurable outcomes, and choose the level of support that fits your stage.

Cost notes for Canadian readers

Salary and fee figures move with market conditions. Recent Canadian salary references place CFO compensation in six figures with experienced roles higher in major cities. Fractional retainers in Canada often start in the low thousands per month and increase with scope for forecasting, modeling, and board reporting. Employers comparing full-time to services should include benefits, statutory contributions, paid time, and overhead in their total cost calculations, as outlined by Canadian help resources from QuickBooks. These checks make your cost comparison precise and current.

FAQs | Virtual CFO vs Full-time CFO

Is a virtual CFO the same as a fractional CFO?

Often used interchangeably; both are outsourced. “Virtual” highlights remote delivery; “fractional” highlights part-time scope.

How much does a virtual/fractional CFO cost in Canada?

Common ranges: ~CAD $150–$350+ per hour or ~CAD $2k–$10k+ per month depending on scope and stage.

What does a full-time CFO earn in Canada?

Many roles in large markets list ~CAD $185k–$300k+ base, before benefits/bonus/equity.

Do privacy rules change if I outsource finance?

No—you remain accountable; use PIPEDA-compliant contracts and disclosures, especially for cross-border processors.

*References for costs in the FAQs above: Ali Asghar CPA, Robert Half+1.