Yes, Canadian business owners can claim business loss on personal taxes. These losses, particularly for sole proprietors and entrepreneurs, can significantly reduce personal tax liability. By understanding how they impact your taxable income, you can take steps to minimize your tax burden.

In Canada, if your business expenses exceed your business income, the resulting business loss can be applied to reduce your personal income tax. This is a critical strategy for small business owners and entrepreneurs, especially those operating under a Master Business License, as it directly impacts their overall tax liability. In this article, we’ll explain how to claim business losses, the rules surrounding it, and provide practical steps for tax preparation.

What is a Business Loss?

A business loss occurs when the costs of running your business exceed the revenue your business generates. These losses can happen in various situations, such as:

- High operational expenses (e.g., rent, wages, utilities)

- Startup costs before the business becomes profitable

- Decline in revenue during tough economic periods

For a sole proprietor or small business owner, these losses may not only affect the business but can also be used to reduce taxable income. Business owners can use the loss to offset income from other sources, including their personal income, thereby reducing their overall tax liability.

In Canada, the Canada Revenue Agency (CRA) allows business losses to be carried forward or backward, depending on specific tax rules, which gives business owners some flexibility in managing their taxes.

Can You Claim Business Loss on Your Personal Taxes in Canada?

Yes, business losses can indeed be claimed on personal taxes in Canada, but it depends on the structure of your business. Most small business owners file as sole proprietors, where the business income is directly tied to their personal income tax return.

When you file your personal tax return, business losses can be applied against your personal income, including salary or other non-business sources of income. This is particularly helpful in reducing your taxable income, ultimately lowering the amount of tax you owe.

Net Operating Loss (NOL) and Excess Business Loss

A Net Operating Loss (NOL) occurs when a business’s allowable deductions exceed its business income for the year. If you experience a net operating loss, the CRA allows you to carry this loss either back to previous years or forward to future years to offset taxes from those periods. This can provide you with tax relief in years when your income is higher, allowing you to balance your tax burden over time.

An excess business loss arises when business deductions exceed a certain threshold. Under Canadian tax laws, the rules about excess business loss depend on the amount, and any loss beyond certain limits must be carried forward.

Key Considerations for Business Owners Filing Personal Taxes

Filing taxes as a business owner is different from filing as an individual with no business income. There are several aspects you need to consider to ensure that you’re maximizing your tax savings:

1. Tax Preparation for Sole Proprietors

If you’re a sole proprietor, you report your business income and expenses directly on your personal tax return (T1). This means:

- Reporting business income and expenses on Schedule T2125

- Keeping accurate records of income and business-related expenses throughout the year

- Ensuring that all deductible business expenses (such as vehicle costs, office supplies, and utilities) are accounted for

2. Filing Jointly and Business Losses

If you’re married or in a common-law relationship and filing jointly, business losses can still be claimed on your personal tax return. However, it’s important to note that while business losses reduce your overall taxable income, they don’t necessarily apply to your partner’s income unless the business is a shared venture or partnership.

3. How Business Losses Impact Personal Income

Claiming business losses on your personal tax return reduces your taxable income, which directly affects what you report on Line 15000 of your tax return. This is particularly useful if you have multiple sources of income, such as salary and business income, as the losses from your business can offset the income from your salary.

Common Tax Situations for Business Owners and How to Handle Them

As a business owner, you might encounter specific tax situations that require careful planning and strategy. Here are some of the most common scenarios:

1. Handling Losses from a Failing Business

In cases where a business continuously operates at a loss, the ability to claim those losses becomes essential. If your business is struggling, you can use those losses to offset your non-business income, such as salary or investment income. This could lead to a refund of taxes previously paid on that income, potentially providing much-needed financial relief.

2. Maximizing Tax Deductions

Maximizing tax deductions is an effective way to reduce the amount of tax owed. Some common deductions for business owners include:

- Travel expenses for business-related trips

- Business vehicle expenses

- Home office deductions

- Depreciation of business assets

- Salaries and wages paid to employees

By properly claiming these deductions, business owners can reduce the overall taxable income, making it easier to claim business losses.

3. Hiring a Tax Professional vs. Doing It Yourself

Business owners often wonder whether to file taxes independently or hire a tax professional. If your business expenses are straightforward, you may be able to manage the process on your own. However, if you’re claiming business losses or have more complex tax situations, hiring a professional can ensure you’re making the most of your tax deductions and claims. A tax professional can also help navigate specific rules surrounding excess business losses and carryforward loss rules.

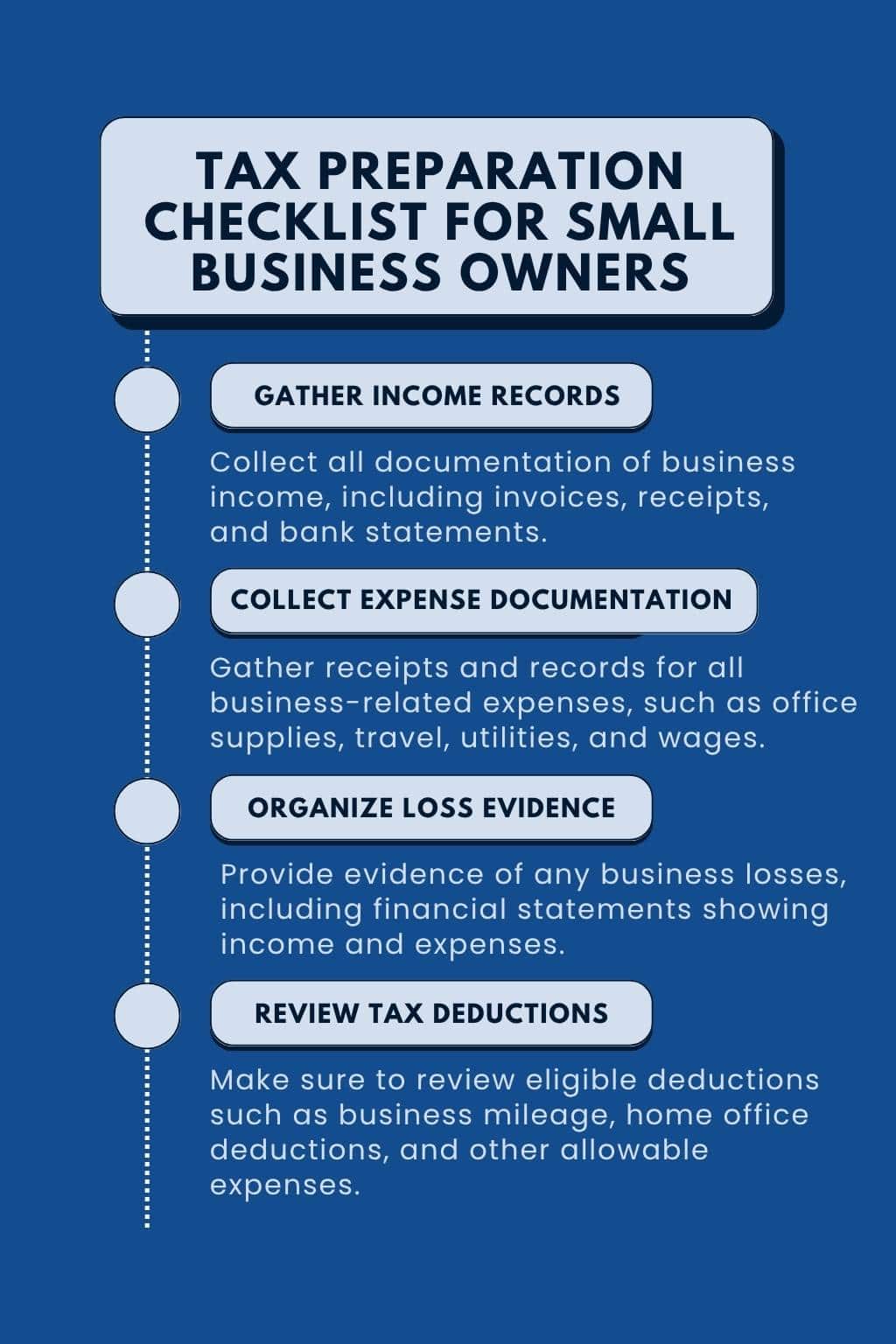

Practical Steps to Reduce Your Tax Liability

There are several effective strategies business owners can use to reduce their tax liability when claiming business losses:

- Keep Detailed Records: Accurate and organized records are essential for maximizing deductions. Keep receipts for all business-related expenses, and ensure you have supporting documents for any loss claims.

- Use Tax Software: Leveraging tax software can simplify the process of filing taxes and ensure you don’t miss any deductions. Many programs are tailored specifically for small businesses and can help calculate business loss claims.

- Consult with a Tax Professional: When in doubt, it’s wise to consult with a tax professional who can help you navigate complex tax situations, especially when claiming business losses.

Conclusion

Claiming business losses on personal taxes can provide valuable tax relief for Canadian business owners. By understanding how business taxes work, maintaining good tax records, and using available deductions, you can reduce your taxable income and ease the financial strain of operating a business. Whether you’re a sole proprietor or an entrepreneur, ensuring you understand the rules around business loss claims is key to optimizing your tax return and reducing your overall tax burden.

FAQs

Can I deduct business losses from personal income?

Yes, if you’re a sole proprietor or in a partnership, you can deduct eligible business losses from your personal income. These losses reduce your overall taxable income and may result in a lower personal tax liability. However, you must meet Canada Revenue Agency (CRA) requirements and ensure the losses are genuine and well-documented.

How much loss can you claim on taxes in Canada?

There is no fixed limit to how much business loss you can claim, but it must be reasonable and supported by documentation. If your expenses exceed income, you can claim a non-capital loss and apply it to your current, previous (up to 3 years), or future income (up to 20 years), depending on CRA rules.

Can I report my LLC losses on my personal return?

In Canada, LLCs are not a recognized business structure like in the U.S. If you’re referring to a U.S.-based LLC owned by a Canadian resident, tax treatment depends on how the LLC is classified for Canadian tax purposes. For a Canadian business owner, if you operate as a sole proprietor or through a partnership, losses can generally be reported on your personal return.