Line 15000 is used to report your total income on the tax return. It reflects your income before any deductions are taken off. Whether you’re an employee, a first-time filer, self-employed, or nearing retirement, clarity on Line 15000 helps you file your taxes accurately, avoid common errors, and possibly save money.

Below, we’ll explore everything you need to know about Line 15000: its significance, the different types of income, and how it impacts your overall tax filing process.

We’ll also briefly touch on a few common questions people often ask as they work on their tax return in Canada.

Why Line 15000 Matters for Every Canadian Taxpayer

Line 15000 matters for every Canadian taxpayer because:

- It provides the total income used to calculate taxable income, which then determines your tax payable.

- These benefits use total income (starting from Line 15000) to assess eligibility.

- Check if you can claim deductions (like RRSP or childcare)

Even a small mistake here can affect your tax refund, benefits, or trigger a CRA audit. Therefore, it’s essential to report every source of income, including jobs, rentals, businesses, and investments.

The Shift from Line 150 to Line 15000 Explained

Not long ago, people used to see Line 150 on their Canadian tax return. It showed your total income—the full amount you earned from work, business, rent, or investments before taxes or deductions.

But then the Canada Revenue Agency (CRA) updated the form and changed the line number to Line 15000. Why? To make things easier and more organized, especially with online tax filing and electronic forms. The new five-digit format helps both CRA systems and tax software work better together.

So, if your parents or friends still talk about Line 150, don’t worry—they’re talking about the same line you’ll now find as Line 15000 on the T1 General Income Tax Return.

Knowing this small change helps you stay up to date and file your taxes the right way. And in the eyes of the CRA, accurate income reporting builds trust, which helps avoid audits or mistakes in the future.

New in 2025 | CRA Phone Verification

When you phone 1-800-959-8281 or request a remittance voucher, the agent will quiz you for the exact figure that appears on Line 15000 of your 2024 or 2023 return – so keep that number handy or grab it from your Notice of Assessment before you call.

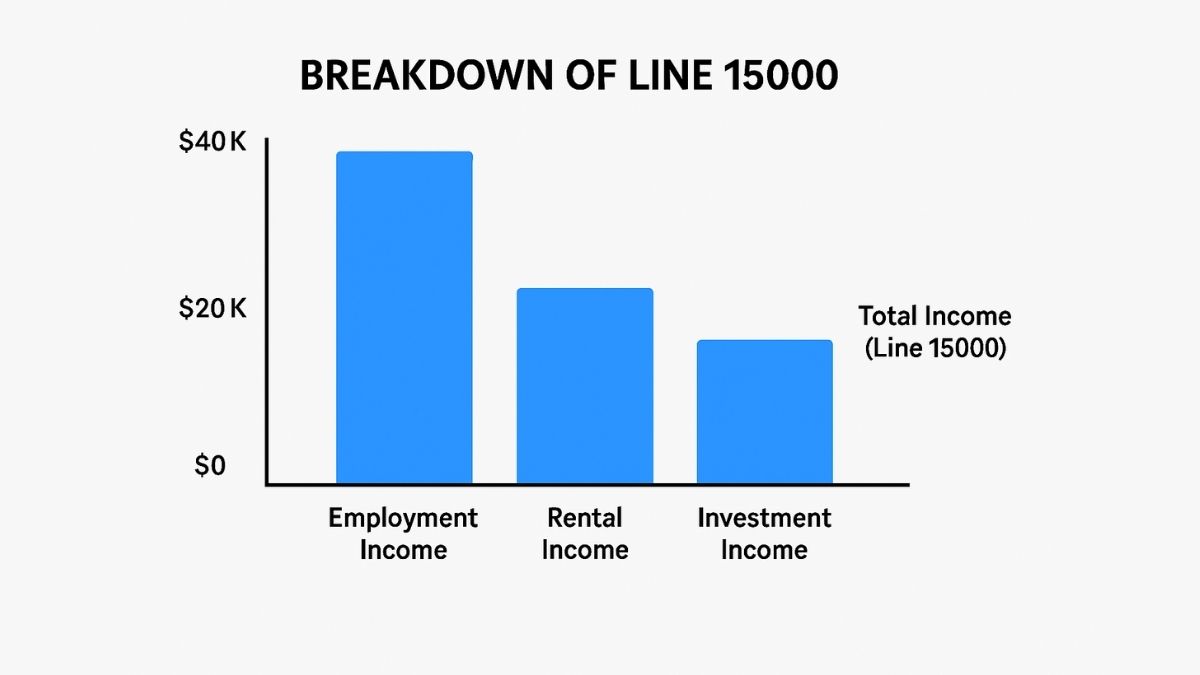

Income Types That Contribute to Line 15000

Tax Calculations

Your total income reported on Line 15000 serves as the starting point for determining taxable income after deductions. The accuracy of this figure impacts the final amount of tax you owe or any refund you may receive.

Employment Income (Line 10100)

If you receive a T4 slip from an employer, the amounts shown—like wages, salaries, or other compensation—go toward Line 10100, which then contributes to your total income on Line 15000. Make sure to add in any other T4 or T4A details, including tips or gratuities.

Self-Employment or Business Income

Freelancers, independent contractors, and small business owners need to sum up earnings from client invoices, minus applicable expenses. This figure contributes to your total business income, which then flows into Line 15000. Inaccurate records or missed transactions can quickly complicate your tax filing process.

Investment Income (T5, Capital Gains, etc.)

Interest, dividends, or capital gains from stocks, bonds, or mutual funds also affect your total income. T5 slips usually detail interest and dividends, while capital gains are reported separately. Make sure you understand how to calculate them properly to avoid over- or under-reporting.

Rental Income

If you rent out a property, the net rental earnings go into your total income. Include every month’s rent but subtract allowable expenses like mortgage interest (if applicable), insurance, and utilities. Underreporting rental income can trigger audits, so keep consistent records.

Pension and Retirement Income

Retirees and pensioners often collect CPP, OAS, or private pension amounts. These all factor into Line 15000, too. Depending on your age and situation, you might also be able to split eligible pension income with a spouse or common-law partner, potentially lowering your family’s overall tax bill.

Eligibility for Credits and Benefits

Several federal and provincial credits and benefits are calculated based on the total income reported on Line 15000. A precise total ensures you receive all benefits you’re entitled to and helps avoid delays or reassessments.

Immigration Sponsorship Checks

Planning to sponsor parents or grandparents?

IRCC checks your “total income” directly from Line 15000 on each of the last three NOAs to see if you meet the minimum necessary income. Under-reporting can sink an application.

Other Income Sources

Additional income, like employment insurance benefits, social assistance payments, or certain lump-sum payments, must also be included. Every source of income contributes to your total income on Line 15000.

From Total to Taxable – How Line 15000 Impacts Your Final Tax Bill

Line 15000 represents total income. It’s not the same as net income or taxable income. The key to a successful tax return in Canada is understanding that Line 15000 is not your final taxable amount. After summing up your total income, you can subtract deductions (RRSP contributions, certain business expenses, union dues, etc.) to arrive at your net income.

Net-income formula

Net Income (Line 23600) = Line 15000 – (sum of Lines 20700-23500). [Canada.ca]

Once net income is calculated, taxable income is generally determined. After that, credits like the personal amount reduce the tax you owe. This multi-step approach ensures that accurately reporting on Line 15000 directly influences what you ultimately owe or get back as a refund.

A Simple Example

Let’s say you have multiple types of income:

- $50,000 from a T4 slip (employment income)

- $5,000 from rental income

- $2,000 from dividends (via T5 slip)

| Type of Income | Amount (CAD) |

| Employment Income | $50,000 |

| Rental Income | $5,000 |

| Dividends (T5 Slip) | $2,000 |

| Total Income (Line 15000) | $57,000 |

Once you file your tax return in Canada, you’d report this combined $57,000 under Line 15000. From here, you could apply deductions like RRSP contributions to reduce your net income.

Common Mistakes People Make with Line 15000

Many people accidentally make errors and face problems like missing out on tax benefits, getting a CRA audit, or owing more tax than expected.

Here are some of the most common missteps:

Common Mistakes to Avoid:

- Forgetting part-time or temporary jobs

Even a few weeks of work need to be included in your income. - Not reporting income from another country

Foreign earnings must be included in your Canadian return. - Mixing up business or side hustle income

If you work for yourself, report it as self-employment income. - Ignoring corrected or late T4/T5 slips

Employers and banks sometimes send updates. Don’t skip them. - Missing small amounts of income

Even $50 in interest can trigger a CRA notice if it’s not reported.

How to Fix and Avoid These Mistakes:

- Always double-check your T4 and T5 slips using the CRA’s My Account tool

- Look out for duplicate or corrected slips from your employer or bank

- If you notice an error, use the CRA ReFILE service or submit a T1-ADJ form to fix it

My Account Mini-guide

How to locate Line 15000 in 60 seconds:

- Log in to CRA My Account → “Tax returns”.

- Click the latest “PDF tax return” link.

- Scroll to “T1 General – Summary”; Line 15000 is in the first income block.

- Or open your Notice of Assessment PDF – page 1, right column.

Tip: Screenshot or jot the number; you’ll need it for CRA calls, bank loans, or RESP withdrawals.

Using Tech to File Your Taxes Accurately

Thanks to digital advancements, using tax software is more convenient than ever. Whether you choose a paid platform or a free online tool, most systems automatically populate amounts from T4 or T5 forms once you connect your CRA account. This helps ensure you get every dollar accounted for.

If you’d like the official overview of filing a T1 return, refer to the CRA’s general income tax benefit package.

If you’re confused about how to handle unique income streams (like business income from a side hustle or complicated investment income), it may be worth consulting a certified accountant.

Line 15000 and Your Eligibility for Benefits and Deductions

The Canada Revenue Agency (CRA) relies on the total income reported on Line 15000 to assess eligibility for multiple tax credits and benefits. These include programs such as the Canada Child Benefit, GST/HST credits, and various provincial or territorial benefits. Accurate reporting ensures you receive only the benefits you qualify for based on your actual income. If you underreport your income, you might receive benefits you’re not eligible for, which can lead to future reassessments, required repayments, interest charges, and penalties. Maintaining complete and accurate income records helps prevent issues with your tax account and avoids unnecessary complications.

Why Line 15000 Isn’t Just About Taxes

Line 15000 includes multiple income sources beyond regular employment. This covers pensions, social assistance payments, unemployment benefits, and other government or private payments received during the year. Each income type is reported using specific slips provided by the payer or agency. For example, pension income typically appears on the T4A slip, while employment insurance benefits are reported on the T4E slip.

Accurately including all these amounts on Line 15000 ensures your total income reflects your full financial situation. Missing any slip or income source can lead to incorrect reporting, which may affect tax calculations, benefit eligibility, and possible future audits.

How the Latest Updates Affect You

Every tax year, the CRA updates guidelines, thresholds, or naming conventions. Keep an eye on official communications to stay informed about changes that might affect Line 15000. For instance, if new pandemic-related benefits or provincial tax credits roll out, these might show up differently on the return. Even subtle shifts in how you report a side gig can influence your final tax balance.

Key 2024–2025 CRA Tax Updates You Should Know

- Basic Personal Amount has increased to ~$15,000, reducing overall tax liability.

- RRSP contribution limit is now ~$32,000, allowing greater deductions.

- Climate Action Incentive payments are no longer part of refunds; now paid quarterly.

- Stricter reporting rules apply for foreign property and income.

- Canada Dental Benefit & Grocery Rebate depend on the income reported on Line 15000.

- Work-from-home deductions remain available, but only under the detailed method starting in 2023 and beyond.

If your earnings vary significantly from year to year, be sure to track them carefully. A big jump might mean a new tax bracket, while a sudden drop could qualify you for benefits you never had before.

P.s: Prevent double-count caveat; if you received EI maternity/parental benefits (Line 11905), the amount is already included in Line 11900. Don’t add it again when rolling up to Line 15000.

Wrap Up

Line 15000 on your tax return in Canada is a pivotal piece of the puzzle that determines what you owe, what credits you can claim, and whether you’ll receive specific benefits. Accurately reporting your type of income, whether from T4 slips, rental activities, or investment income, ensures you stay compliant and make the most of your deductions.

👉 Need personalised guidance? Book a 15-minute free call with a SAZ SQUARE tax strategist—get clarity on Line 15000 plus every deduction you deserve.

FAQs

What Is a T4 or T5 Slip?

A T4 slip comes from your employer and shows your salary or wages.

A T5 slip shows income like interest or dividends from a bank or investment.

You may receive other slips too, depending on your income sources.

These slips help fill out your Line 15000 total income.

What if I forgot a T4 slip after filing my return?

You can still file an adjustment. Use the T1-ADJ form or the CRA’s Refile service to correct your total income on Line 15000. The sooner you fix it, the less chance of penalties or accumulated interest.

Do I need to report small side-hustle earnings?

Yes. Even if you earned just a few hundred dollars, it counts as business income or self-employment income and needs to be included. Missing this might cause an audit down the line.

Is Line 15000 the same as my net income?

No. Line 15000 indicates your total income before deductions. After subtracting items like RRSP contributions or certain expenses, you arrive at net income on Line 23600.