In Canada, many small and medium businesses rely on Notice to Reader financial statements as a cost-effective way to present their financial data. These reports are prepared by CPAs but offer no assurance, meaning the CPA compiles the financial information provided by management without verifying its accuracy.

We understand that many Canadian business owners and shareholders wonder: What exactly is an NTR? How does it differ from an audited or accountant-reviewed report? Let’s dive into these questions while highlighting key aspects such as compilation engagements, structured formats, and the role of chartered accountants.

What is a Notice to Reader (Compilation Engagement)?

A Notice to Reader, now officially called a Compilation Engagement in Canada, is the most basic form of financial statement prepared by a Chartered Professional Accountant (CPA). It is based entirely on information provided by management, without any verification or assurance from the accountant. This means the CPA does not audit, review, or confirm the accuracy or completeness of the data.

In simple terms, the CPA takes the company’s raw financial data and organizes it into standard financial statements, such as a balance sheet and income statement. However, because the CPA does not verify the information, the report includes a clear disclaimer stating that no assurance is provided. The reader is cautioned that these financial statements may not be appropriate for all purposes.

This type of report is often used by small businesses, sole proprietors, partnerships, and start-ups that need professionally prepared financial statements but do not require the more extensive procedures of a review or audit engagement.

The Canadian Regulatory Landscape

Canadian businesses operate under specific financial reporting requirements. Under the Accounting Standards for Private Enterprises (ASPE), many small companies opt for a notice to reader financial statements. If you’re just starting out or formalizing your business structure, securing a Master Business License in Canada is often one of the first steps toward compliance and proper financial reporting. These standards make it easier to compile financial data while meeting basic compliance needs.

The Canada Revenue Agency (CRA) accepts these statements in various contexts. However, it is essential to note that while CRA guidelines do not mandate an audit for every business, the disclaimer of “no assurance” in an NTR means that stakeholders should understand its limitations.

For businesses operated by individuals unsure about their tax obligations due to residency status, understanding the concept of factual residency is key.

Legal and liability issues also come into play. Since NTRs do not involve an independent audit, the accountant’s responsibility is limited to presenting the provided information. This means business owners must take extra care to ensure data accuracy. For additional insights on maintaining trust and transparency in financial reporting, contact us now.

Regulatory Standards: CSRS 4200 (New Canadian Standards)

Since December 2021, Canadian accountants follow the CSRS 4200 standard for compilation engagements. This new standard clarifies the responsibilities of both the CPA and business management. It ensures transparency by requiring the CPA to disclose the basis of accounting used and confirm management’s responsibility for the information. This enhances consistency across compiled financial statements while still offering no assurance.

Who Can Prepare an NTR?

Only licensed Chartered Professional Accountants (CPAs) in good standing can prepare and sign an official Compilation Engagement in Canada. Bookkeepers or non-certified accountants cannot issue an NTR report under CSRS 4200. While management provides the data, the CPA is responsible for following professional standards when preparing and presenting the final report.

How NTRs Compare to Other Financial Reports

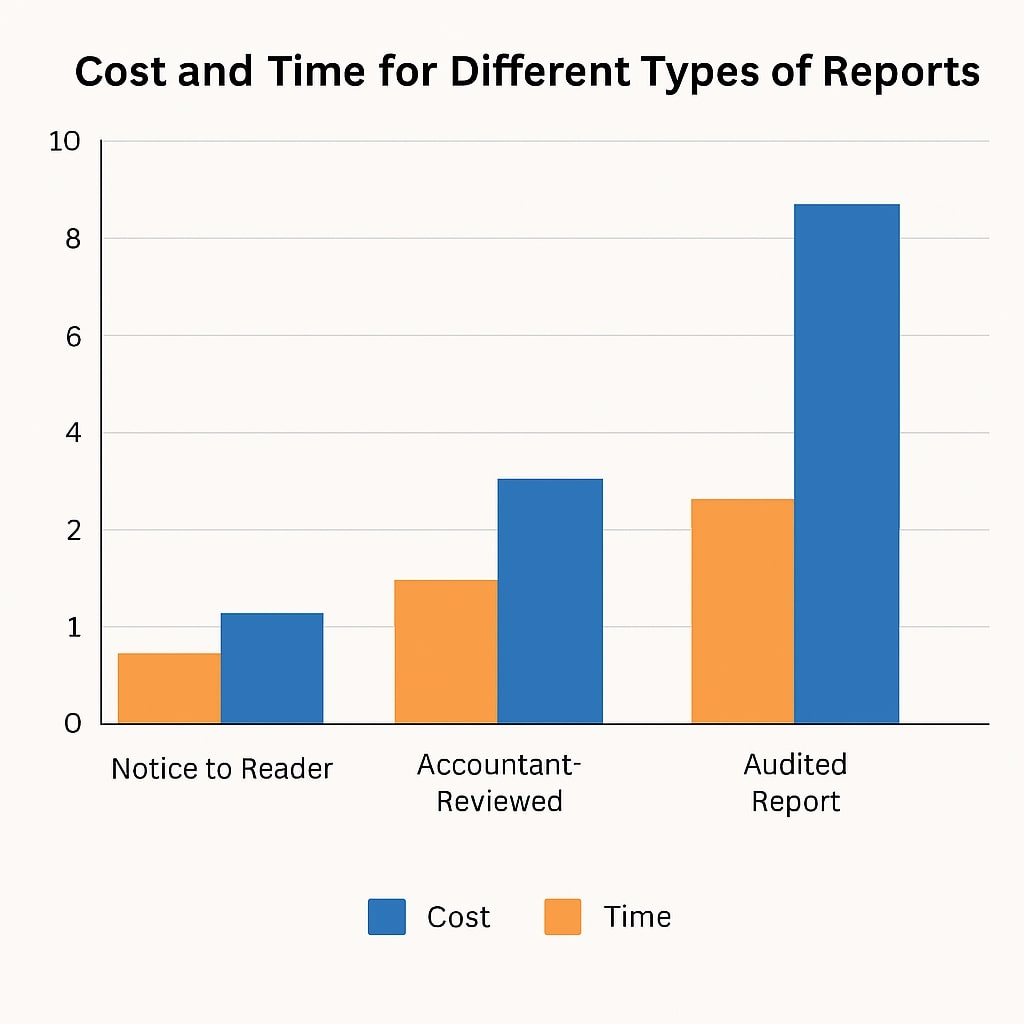

A common question is how notice to reader financial statements differ from audited and accountant-reviewed reports. NTRs are less rigorous and less costly. While an independent audit or accountant-reviewed report offers a higher level of assurance, they involve more extensive testing and validation procedures.

For more complex financial needs such as valuations, mergers, or compliance with investor standards, businesses may consult professionals like a Certified Valuation Analyst (CVA), who specializes in in-depth financial assessments and value determination.

NTRs are ideal when cost and time are significant factors. They focus on compiling information provided by the business without verifying every detail. In contrast, an independent audit subjects your financial data to a thorough examination, making it suitable for larger enterprises or situations where lenders require stricter assurances.

This table below summarizes the key differences:

| Report Type | Level of Assurance | Cost | Time Involved |

| Notice to Reader (Compilation Engagement) | None | Low | Quick turnaround |

| Reviewed Financial Statements | Limited | Medium | Moderate |

| Audited Financial Statements | High | High | Extensive |

Who Benefits from Notice to Reader Reports?

Notice to reader financial statements are particularly useful for businesses that need a basic yet structured presentation of their financial position. They suit small to mid-sized private companies and start-ups where full audits might not be economically feasible.

Stakeholders, such as shareholders and potential investors, can quickly get an overview of a company’s balance sheet and statement of operations. Lenders may also accept an NTR for early-stage financing, although they sometimes prefer the rigor of a reviewed or audited report.

Business owners should consider their current and future financing needs when deciding on the type of report. If your business is growing rapidly, it might be wise to move from an NTR to a more robust reporting system eventually.

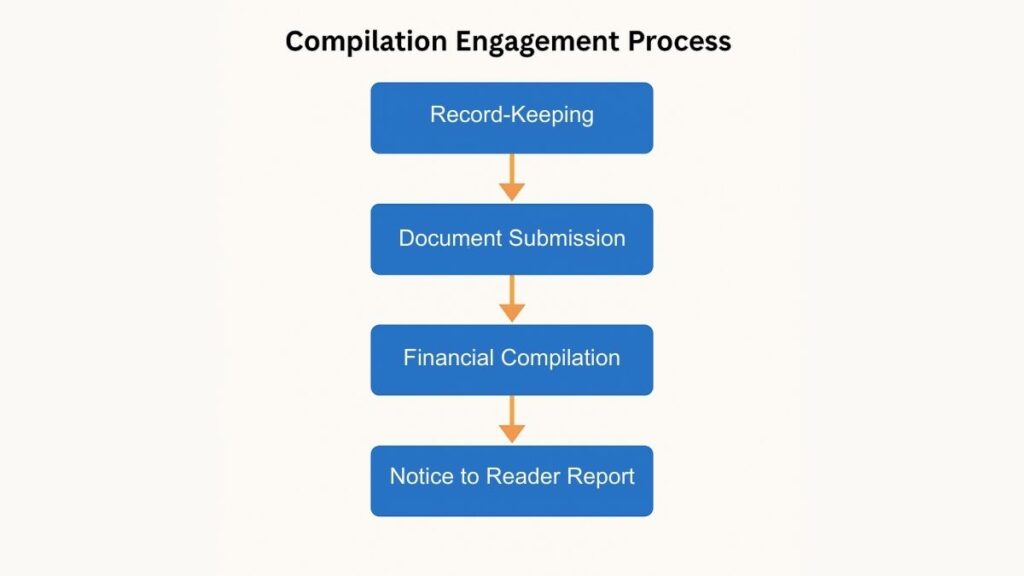

What Happens During a Notice to Reader Engagement?

During a notice to reader engagement, your independent accountant compiles the financial data you provide. This process involves collecting bank statements, receipts, payroll records, and other relevant financial documents. The compilation engagement is largely a matter of organizing information into a structured format.

The resulting report usually includes the balance sheet, statement of operations, and changes in net assets. In many cases, additional supporting notes or schedules are also prepared. While the process is straightforward, its success hinges on the accuracy of the information you supply.

Using accounting software like QuickBooks or Xero can simplify this process. When records are well-maintained, your independent accountant can produce a neat and clear compilation report, giving stakeholders a snapshot of your business’s financial health.

Limitations and Pitfalls of NTRs

While notice to reader financial statements offer cost and time benefits, they come with limitations. The key drawback is the “no assurance” disclaimer. This means that if errors exist in the data, they will not be uncovered through independent verification.

Because of this, stakeholders should avoid relying solely on NTRs for major financial decisions, such as raising capital or seeking extensive financing. In some cases, the lack of assurance might lead to misinterpretations, especially if the business data is incomplete or outdated.

Moreover, if the financial statements are used in scenarios that demand higher scrutiny, such as mergers or acquisitions, relying on an NTR could pose risks. Always consult with a trusted advisor to determine if an upgraded report, like an audited financial statement, is warranted. For a deeper dive into related advisory roles, check out here exactly what’s the difference between advisor and consultant.

Best Practices for Canadian Business Owners

To maximize the benefits of notice to reader financial statements, follow these best practices. First, choose a reputable CPA firm or an independent accountant with strong credentials. Their expertise and experience will add credibility to your report.

Maintain clean and organized financial records throughout the year. This proactive approach not only speeds up the compilation engagement but also ensures that the final report accurately reflects your business operations. Consider using modern cloud-based solutions to streamline record-keeping.

Regular financial reviews are also vital. As your business grows, periodic assessments can help you decide whether to upgrade to an accountant-reviewed or audited report. This step is crucial for building long-term trust with stakeholders and lenders.

For further insights into accounting standards, visit CPA Canada.

A Real-World Look | A Canadian Tech Startup

Imagine a small tech startup in Toronto. The founders need to present their financial status to potential investors without incurring high audit fees. They opt for a notice to reader financial statement prepared by a well-regarded independent accountant.

The process begins with gathering digital records from their cloud accounting software. The accountant compiles the balance sheet, statement of operations, and changes in net assets. The report is clear, structured, and delivered within a short timeframe.

Although the investors understand the report comes with “no assurance,” it provides a solid snapshot of the startup’s financial position. This approach allows the founders to focus on growth while planning for a more comprehensive audit in the future if needed.

Common Questions

Many business owners have concerns about the practical implications of notice to reader financial statements. Questions such as “Will banks accept an NTR?” or “Does an NTR protect me from errors?” often arise.

Banks and investors might accept an NTR for early-stage companies or small business loans, but they usually prefer a higher level of assurance when larger sums are involved. It is important to communicate clearly with your financial partners about the nature of the report.

Additionally, while an NTR does not offer the verification provided by an audit, it remains a valuable tool for internal management. Business owners should always supplement an NTR with regular internal reviews and updated financial controls.

Key Takeaways for Canadian Entrepreneurs

Notice to reader financial statements provide a cost-effective solution for presenting financial data. They help you fulfill basic financial reporting requirements in Canada without the need for a full independent audit.

However, always weigh the benefits against the limitations. The absence of assurance means that the data is only as reliable as the information provided. For companies with growth aspirations or significant external financing needs, moving to a more robust reporting format might be essential.

By staying on top of your financial record-keeping and choosing the right independent accountant, you can ensure that your NTR serves as a reliable snapshot of your company’s performance. This strategic approach enhances trust with stakeholders and lays the groundwork for future financial transparency.

NTR vs. Review vs. Audit

A Notice to Reader (Compilation) organizes management-prepared data into standard statements with no assurance. A Review offers limited, “negative” assurance through inquiries and analytics. An Audit provides high assurance via extensive substantive testing and internal control evaluation

| Engagement Type | Assurance Level | Scope of Procedures | Typical Use Cases |

|---|---|---|---|

| Notice to Reader (Compilation) | None | Compiles client-provided data; mathematical checks; CPA issues “no assurance” disclaimer (robeycpa.ca, gevorgcpa.com) | Small businesses, internal reporting, basic taxation |

| Review Engagement | Limited (“negative”) | Inquiries, analytical procedures, discussion with management; ensures plausibility | Financing mid-sized loans, third-party stakeholders, mid-level assurance needs |

| Audit Engagement | High (“reasonable”) | Extensive testing, document inspection, internal control evaluation; issues audit opinion | Public companies, high-stakes financing, legal/regulatory compliance |

Making the Right Financial Reporting Choice

Notice to reader financial statements are a practical solution for many Canadian businesses. They provide a structured format for compiling financial data at a lower cost and with a quick turnaround. While the “no assurance” label limits their use for certain high-stakes decisions, they remain an excellent tool for small and mid-sized enterprises.

As you plan your financial strategy, consider whether an NTR meets your current needs or if you should opt for a more thorough accountant-reviewed or audited report. For personalized advice and further insights into effective financial reporting, visit SAZ Square.

Embracing transparency and regular financial reviews builds long-term trust with shareholders and stakeholders. With the right approach, you can navigate Canada’s financial reporting requirements with confidence and clarity.

FAQs

What exactly is a notice to reader financial statement?

It is a Compilation Engagement, a professional set of financial statements prepared by a CPA using information provided by management. It organizes your financial data into a balance sheet and income statement, but includes a clear disclaimer: no audit or review was performed.

Are NTRs acceptable for bank loans or investor presentations?

Yes, Notice to Reader (NTR) financial statements are widely accepted by banks and some investors, especially for early-stage businesses or modest financing needs. While they provide no assurance, many lenders and investors consider them sufficient proof of financial standing in lower-risk situations.

How can I ensure my NTR is reliable?

To ensure your NTR is reliable, have your financial data reviewed by a licensed CPA, maintain well-organized and reconcilable records, and address any unreasonable items with professional judgment. This builds credibility and helps ensure the compiled statements accurately reflect your financial position.

What is the Notice to Reader Report?

A Notice to Reader Report is a set of unaudited financial statements assembled by a CPA using information provided by management. It includes a disclaimer stating no audit or review was performed and is marked “unaudited.”