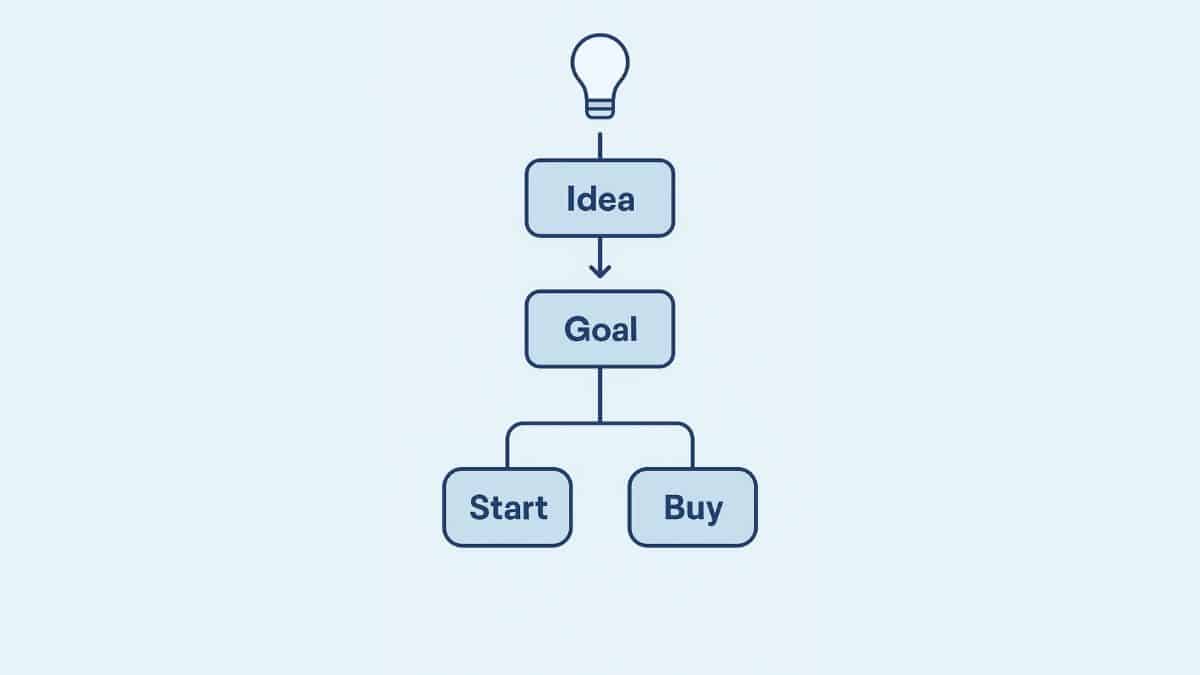

If you want complete creative control, more time to build momentum, and lower initial cash outlay, start a business. If you need immediate cash flow, a proven customer base, and are comfortable paying a premium for stability, buy a business. Both paths work in Canada’s dynamic economy; the right choice depends on your goals, risk tolerance, and capital.

Quick Take: Which Path Suits You?

| Your Priority | Better Fit |

| Launch fast with existing revenue | Buy |

| Keep costs lean at the outset | Start |

| Full control over brand and culture | Start |

| Easier bank financing | Buy |

| High growth through acquisition synergies | Buy |

| Build something unique from scratch | Start |

Why Canadians Ask “Start vs. Buy”

Rising interest rates, tight labour markets, and record retirements among Baby-Boomer owners have flooded the market with businesses for sale. Meanwhile, federal and provincial grants keep fuelling new-venture optimism. These forces make the Start A Business Or Buy One debate unavoidable for founders weighing speed, cost, and risk. Recent studies show roughly 90 percent of Canadian startups ultimately shut down (growthlist.co), yet acquisitions backed by lender due diligence enjoy higher survival rates because of existing cash flow and collateral.

Clarify Your Personal and Strategic Goals

Before you crunch numbers, map out:

- Lifestyle goals. Do you crave the freedom to design every process? Start. Prefer operational stability from day one? Buy.

- Risk appetite. Comfortable with market validation risk? Start. Prefer known earnings? Buy.

- Capital reality. Savings under $100k lean toward bootstrapped startups. Larger equity or lender backing opens the acquisition door.

- Timeline to paycheque. Startups may run 6–24 months before salary. Acquisitions can pay you month one.

Option A: Starting a New Business in Canada

Benefits of Starting From Scratch

You own the brand vision, intellectual property, and workplace culture. You can adopt cutting-edge tech without legacy roadblocks. Scaling decisions stay entirely yours.

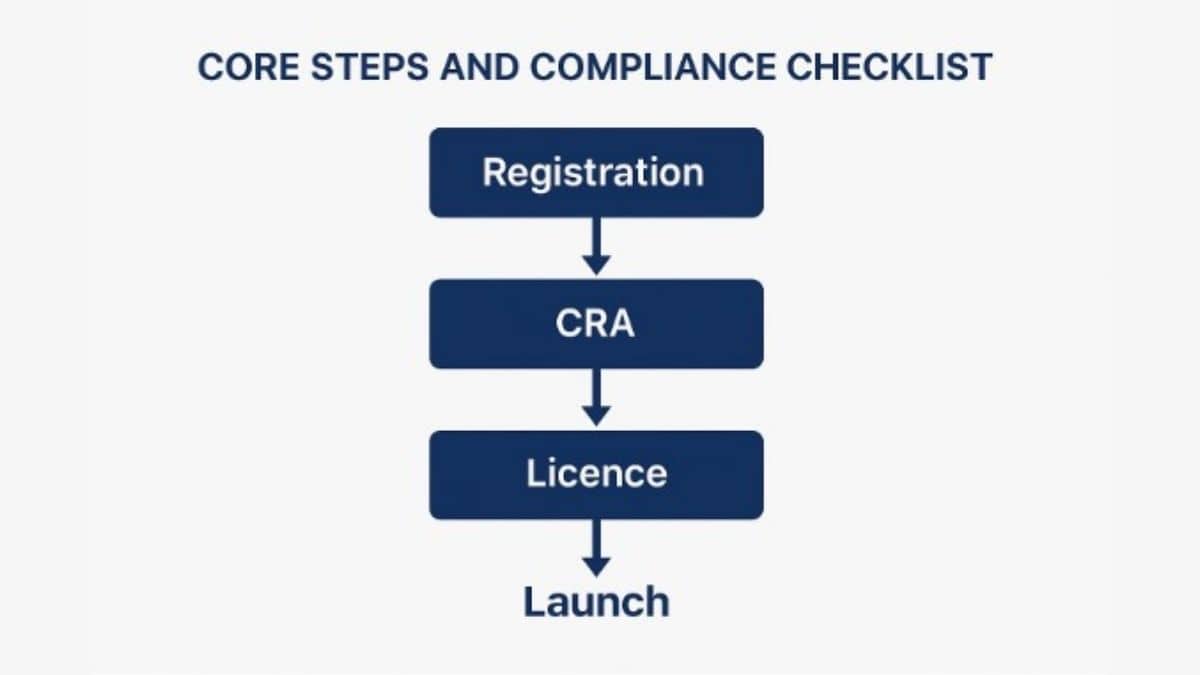

Core Steps and Compliance Checklist

- Validate the market. Interview potential customers, run lean experiments, and craft a data-backed business plan.

- Choose a structure. Sole proprietorship, partnership, or corporation. Incorporation protects liability and attracts investors.

- Register federally or provincially. Use the Government of Canada’s Business Registration Online portal for CRA accounts.

- Secure licences and zoning. Check municipal rules and industry regulators.

Startup Costs and Typical Timeframes

| Expense Category | Approximate Range (CAD) |

| Incorporation & permits | $300 – $1,500 |

| Equipment & software | $5,000 – $50,000 |

| Leasehold & utilities | $2,000 – $10,000 per month |

| Marketing launch | $3,000 – $20,000 |

Break-even often arrives in year two, though tech ventures may stretch longer.

Financing a Startup

Personal savings remain the most common launchpad for founders in Canada. Cash you already control gives you maximum flexibility, keeps ownership intact, and proves commitment to lenders later. Bootstrapping also disciplines spending because every dollar leaves your pocket.

If personal funds run short, federal programs can bridge the gap. Futurpreneur offers loans up to $75,000 paired with mentorship, which lowers early-stage risk (Futurpreneur Canada). For larger needs, the Canada Small Business Financing Program backs term loans to $1,000,000 through chartered banks (Helping small businesses get loans | Canada.ca). This guarantee reassures lenders even when the venture lacks collateral or a lengthy credit record.

Angel groups and venture-capital firms step in once the product–market fit is clear and scalable growth appears realistic. They inject equity and strategic guidance but expect a clear exit path. Prepare detailed investor documents so you meet due-diligence demands quickly.

Crowdfunding suits consumer brands that need demand validation and community buzz. A successful campaign doubles as free market research while adding non-dilutive capital to your balance sheet. Choose a platform with strong Canadian traffic and set reward tiers that reflect manufacturing economics.

Option B: Buying an Existing Business in Canada

Why Buy? Key Advantages

Buying an established company delivers cash flow on day one. You inherit customers, staff, and systems that already work, which shortens the ramp to salary or dividends. Lenders also look favourably on historical financial statements because they can test repayment capacity against proven results. The same numbers help you negotiate better rates and longer amortisation.

Most sellers remain available for a transition period. Their coaching reduces knowledge loss, secures key relationships, and builds confidence among employees who might fear new ownership. With proper planning, you step into a business that pays you while you refine strategy rather than struggling to reach break-even.

The Acquisition Process

- Define target criteria. Industry, size, region.

- Search channels. Brokers, BizBuySell, PKF hotelexit listings.

- Valuation. Mix cash-flow multiples and asset appraisals.

- Letter of intent (LOI). Non-binding framework.

- Due diligence. Deep dive into finances, legal exposure, operations, and HR records.

- Purchase agreement and closing. Lawyer drafts terms; funds transfer; licences update.

Hidden Risks to Watch

A single customer responsible for more than thirty percent of revenue is a warning sign. Losing that account could erase profits overnight, so insist on diversified sales before closing. Inspect equipment and real-estate leases as well. Outdated machinery or space coming up for renewal may require heavy spending soon after purchase. Finally, unfunded pension or severance obligations can turn into surprise liabilities that drain working capital.

Financing a Purchase

Financing tools exist to offset these risks. Chartered-bank term loans under the CSBFP now include goodwill, letting you borrow against intangible value within the one-million-dollar cap. BDC’s Buy-and-Transfer program adds flexible amortisation that accommodates integration costs (Business purchase or transfer financing – a loan | BDC.ca). Vendor take-back notes, often covering ten to forty percent of price, keep sellers invested in the company’s future. If a further gap remains, BDC Growth and Transition Capital supplies mezzanine debt based on cash flow rather than hard assets (How to finance a business acquisition | BDC.ca).

Start vs Buy: Side-by-Side Analysis

| Factor | Start | Buy |

| Up-front cash | Lower (bootstrapping possible) | Higher (equity + debt) |

| Time to revenue | 6–24 months | Immediate |

| Control & culture | Total control | Must respect legacy |

| Financing ease | Tough (no history) | Easier (collateral) |

| Failure risk | High at 90 percent | Lower with proven records |

| Growth ceiling | Scalable from blank slate | May plateau without reinvestment |

Legal and Tax Considerations

Choosing between an asset purchase and a share purchase determines future exposure. Asset deals allow you to select only the assets you want and leave hidden debts behind. Share deals preserve existing licences and contracts but also pass every liability to the buyer.

When assets move, you can file a Section 167 election so GST or HST does not apply at closing, preserving cash. Real property inside the package may attract provincial land-transfer tax, so model this cost early. Successor liability rules add another layer. Environmental cleanup orders or unpaid payroll claims can follow the enterprise, not the owner, so forensic due diligence is essential.

Note: A tax lawyer can structure the agreement to optimise after-tax cash flow and protect against these surprises.

Decision Checklist: Which Path Is Right for You?

| Question | Score 1–5 |

| How much capital can I deploy today? | |

| Do I accept a 90 percent failure risk for high upside? | |

| Does brand creation excite me? | |

| Can I wait a year for salary? | |

| Am I ready to lead staff on day one? |

Assess your readiness with five questions. First, calculate how much capital you can allocate without straining personal finances. Second, gauge whether you can tolerate a ninety-percent startup failure statistic for the chance at outsized gains. Third, ask if building a brand from the ground up excites you. Fourth, decide whether you can go a year without pay while the venture matures. Fifth, consider if you are prepared to lead an inherited workforce on day one.

Score each item from one to five. A high total on capital and immediate-income needs points toward buying a business in Canada. High scores on creativity and patience lean toward starting from scratch.

Use our tool above to anchor your Start A Business Or Buy One decision in objective data rather than emotion.

Canadian Programs & Support

- BDC Advisory Services. Growth planning and acquisition transition coaching.

- FedDev Ontario seed funding for innovative startups.

- CanExport grants covering up to 50 percent of export marketing costs.

- Regional Development Agencies across Atlantic, Prairies, and Northern Ontario offer repayable contributions.

Growth Strategy After Launch

Franchising replicates a winning model with lower unit cost because each franchisee funds site development. Standardised processes protect brand consistency while accelerating national coverage.

Bolt-on acquisitions offer another growth lever. Buying suppliers or direct competitors can expand margins, extend geographic reach, and absorb new talent. Analyse synergy potential before bidding to avoid overpaying for scale.

Diversification rounds out the strategy once cash flow stabilises. Adding related product lines or services guards against market downturns and widens customer lifetime value. Each move should link back to your core strengths and long-term vision.

SAZ Square prepares investor decks that attract capital for any of these moves.

Operational Challenges and Mitigation

Starting From Scratch: Secure early adopters by shipping a minimal viable product fast and iterating on feedback. Allocate at least twenty percent more than your initial marketing budget so you do not stall lead generation. Track burn rate monthly to catch cash-flow gaps before they threaten payroll.

Integrating an Acquisition: Retain top employees with stay bonuses and transparent communication so institutional knowledge stays intact. Unify software within ninety days to prevent data silos. Notify customers quickly, highlighting continuity and new value the change brings. This approach sustains revenue momentum while you embed your leadership style.

Due Diligence Essentials When Buying

Financial review should include forensic accounting, working-capital analysis, and normalised EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization). Legal counsel checks liens, litigation, and intellectual property. Operational audits verify equipment condition and supplier contracts. Skipping any layer compounds risk.

So, Will You Start A Business Or Buy One…

Look, both routes can build generational wealth.

Start A Business Or Buy One decisions hinge on cash, timeline, and appetite for uncertainty. Startups reward innovation but carry high failure odds. Acquisitions reduce initial risk and speed earnings yet demand larger capital and integration skill. Assess your resources honestly, lean on Canadian financing programs, and call on SAZ Square for investor-ready documents that turn either vision into reality.

FAQs

How to buy an existing business with no money?

Use vendor take back loans, earn-outs tied to performance, and government-guaranteed financing while contributing sweat equity and offering lender collateral.

How would the seller of a business prefer to be paid?

Most sellers favour upfront cash for certainty but will accept staged payments or vendor financing when the premium and security are adequate.

How to buy a business?

Identify targets, sign NDAs, review financials, negotiate valuation, secure financing, conduct thorough due diligence, then close with a lawyer-vetted purchase agreement.

Should I buy a business?

Buy if you have capital, want instant cash flow, and can handle integration risks; start instead when creativity and lower entry costs are priorities.

Is it worth buying an existing business?

Yes, provided the price matches stable earnings, transferable goodwill, and growth potential that outweigh financing costs and integration effort.

What are the disadvantages of buying an existing business?

High purchase price, hidden liabilities, cultural clashes, outdated systems, and possible customer churn during the handover can reduce expected returns.

What is the success rate of buying an existing business?

Canadian surveys indicate acquired firms survive beyond five years about 60 to 70 percent of the time, markedly better than typical startup rates.