A factual resident of Canada is someone who lives or travels outside the country but maintains significant residential ties with Canada. According to the CRA (Canada Revenue Agency), this status means you’re still considered a resident for income tax purposes. Even if you live abroad temporarily or for extended periods, certain connections to Canada may keep you in the tax system.

This is different from other categories like non-resident, deemed resident, or deemed non-resident. Each has unique rules. Factual residency hinges on the strength of your personal, social, and economic ties to Canada.

Residential Ties That Make You a Factual Resident

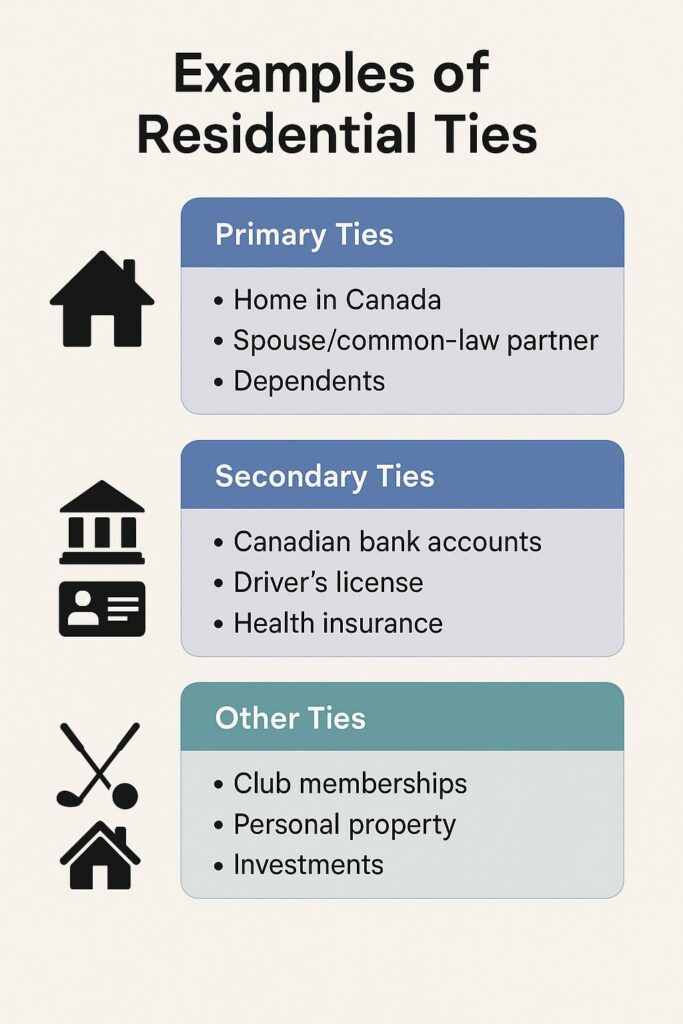

The Canada Revenue Agency (CRA) uses a set of criteria to determine whether you’re a factual resident. These are generally divided into primary and secondary ties.

Examples of Residential Ties

| Type of Tie | Examples |

|---|---|

| Primary Ties | Home in Canada, spouse/common-law partner, dependents |

| Secondary Ties | Canadian bank accounts, driver’s license, health insurance |

| Other Ties | Club memberships, personal property, investments |

The CRA reviews all these ties collectively. Having one or two may not be enough, but a combination of several can establish your factual residency.

Read the Rules for Factual residents – Temporarily outside of Canada

How the CRA Determines Factual Residency

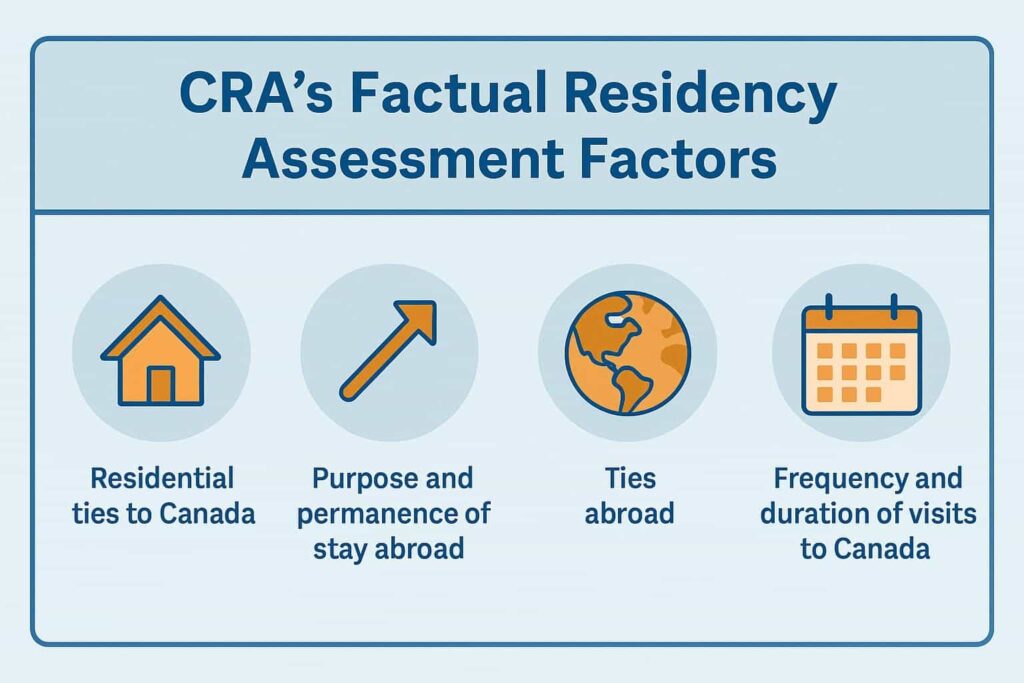

The CRA evaluates each case individually. There’s no single checklist that guarantees a certain status. Instead, they look at the entire picture, including:

- Your residential ties to Canada

- The purpose and permanence of your stay abroad

- Your ties abroad

- The frequency and duration of visits to Canada

For instance, someone who moves abroad for work but keeps their house, bank accounts, and family in Canada may still be considered a factual resident. On the other hand, if you cut most of your ties and establish new ones in another country, you may be considered a non-resident.

Tax Obligations of a Factual Resident

As a factual resident, you’re required to file a Canadian tax return every year. You must report your worldwide income and this includes income from both Canadian and foreign sources.

Fortunately, Canada has tax treaties with many countries. These treaties help prevent double taxation through foreign tax credits. You may also be eligible for various federal and provincial tax credits and deductions.

Being a factual resident ensures you remain part of Canada’s tax system, which may benefit you if you plan to return or maintain access to Canadian services.

Common Situations That May Apply

Several real-life scenarios might result in someone being classified as a factual resident. Here are a few examples:

- Working abroad temporarily: You moved overseas for a 2-year work assignment, but your home and family are still in Canada.

- Snowbirds: You spend winters in the U.S. but return to Canada for the summer, keeping most of your ties in Canada.

- International students: You study in another country but maintain Canadian ties like bank accounts, housing, or family.

- Government employees and military personnel: You may work outside Canada, but due to the nature of your role, your ties remain intact.

Each case will be examined differently. If you fall under one of these examples, it’s best to keep detailed records.

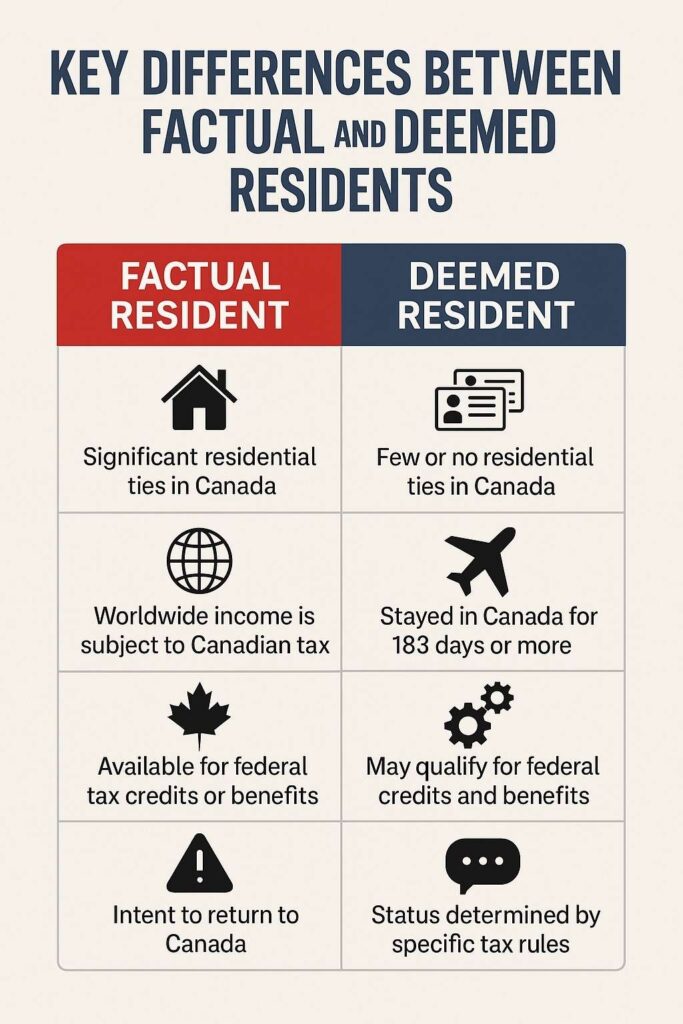

Factual Resident vs. Deemed Resident

The difference between factual and deemed residency can be subtle but important. The following are the key differences.

- Factual residents are outside Canada but maintain significant ties.

- Deemed residents typically don’t have strong ties but meet certain time-based conditions. For instance, if you’re in Canada for 183 days or more in a year without significant ties, you may still be considered a deemed resident.

Comparison Table: Factual vs. Deemed Resident

| Criteria | Factual Resident | Deemed Resident |

|---|---|---|

| Duration in Canada | May live abroad | 183+ days in Canada |

| Strong residential ties | Yes | Not required |

| Worldwide income taxed | Yes | Yes |

| CRA Evaluation | Case-by-case | Based on physical presence |

Understanding this distinction helps you stay compliant with the CRA and avoid unnecessary penalties. It will also help clarify what is a factual resident of Canada.

How to Confirm Your Residency Status?

If you’re unsure about your status, the CRA offers two forms to help determine it:

- Form NR74 – For individuals entering Canada

- Form NR73 – For individuals leaving Canada

Filling out these forms gives the CRA a better picture of your situation. While their feedback is not legally binding, it offers useful guidance. For complex situations, consider hiring a tax professional to avoid errors.

You can also request an official ruling from the CRA. This provides written clarification about your residency status and helps avoid confusion later.

Consequences of Misreporting Residency

Failing to declare the correct residency status can result in serious consequences:

- Penalties and interest: If you don’t report all income correctly, you could face heavy fines.

- Audits: Misreporting can trigger an audit, where CRA investigates your tax filings.

- Legal issues: Repeated non-compliance may lead to legal action or restrictions.

Avoiding these problems starts with understanding your correct status and keeping good records of your ties to Canada.

Final Thoughts & Summary

If you’re living outside Canada but still connected to it financially or personally, you may be a factual resident. In this case, you’ll need to file taxes in Canada and report your global income.

Here’s a quick recap:

- Strong ties = more likely to be a factual resident

- CRA assesses each case individually

- Factual residents’ file on global income

- Use Form NR73 or NR74 to check the status

- Keep records and seek expert help when in doubt

FAQ

What are the different types of residency status in Canada?

Canada classifies individuals into four main residency types for tax purposes:

1. Factual Resident – You live or travel outside Canada but maintain significant residential ties (like a home, family, or bank accounts).

2. Deemed Resident – You stay in Canada for 183+ days in a year without strong residential ties.

3. Non-Resident – You live abroad and have severed most residential ties with Canada.

4. Deemed Non-Resident – You meet the deemed resident conditions but are also considered a resident of another country under a tax treaty.

Are snowbirds factual residents?

Yes, snowbirds can be considered factual residents. If you spend winters in the U.S. but keep strong ties to Canada, like owning a home, having a spouse or dependents in Canada, and using Canadian health services, you’re likely still a factual resident and must file taxes in Canada.

What happens to your residency status if your situation changes?

Your residency status may change if your personal ties shift significantly. For example, if you sell your home, move your family abroad, and close your Canadian bank accounts, you might become a non-resident. The CRA evaluates each situation case-by-case, so always update your details and seek advice if your life circumstances change.

How Do I Become a Deemed Resident of Canada?

You become a deemed resident if you stay in Canada for 183 days or more in a calendar year and don’t have significant residential ties. Even if you don’t own property or have close personal connections here, your physical presence alone could place you in this category. In that case, you’ll need to file taxes on your global income.