Real Estate, Technology & Software Development, and Healthcare Services are some of the best businesses to buy in Canada right now if you’re an entrepreneur or investor considering business acquisition. Purchasing an existing business offers immediate market presence, established customer bases, and operational frameworks—advantages that starting from scratch cannot match. In 2025, Canada’s diverse economy presents numerous profitable sectors ripe for acquisition. This blog covers the top businesses, acquisition processes, regional opportunities, and strategies to maximize your investment.

Why Buy an Existing Business in Canada?

Advantages Over Starting from Scratch

Acquiring an established business provides several benefits:

- Immediate Revenue Streams: Begin generating income from day one.

- Established Brand Recognition: Leverage existing customer trust and loyalty.

- Proven Business Model: Benefit from tested operational strategies and market positioning.

Moreover, Canada offers various financial incentives for business acquisitions:

- Share Purchase Advantages: Potential tax deferrals and capital gains exemptions.

- GST/HST Implications: Proper structuring can lead to tax efficiencies.

- Government Grants and Subsidies: Programs available for specific industries and regions.

Economic Stability

Canada’s robust economic framework, political stability, and favorable trade agreements make it an attractive destination for business investments.

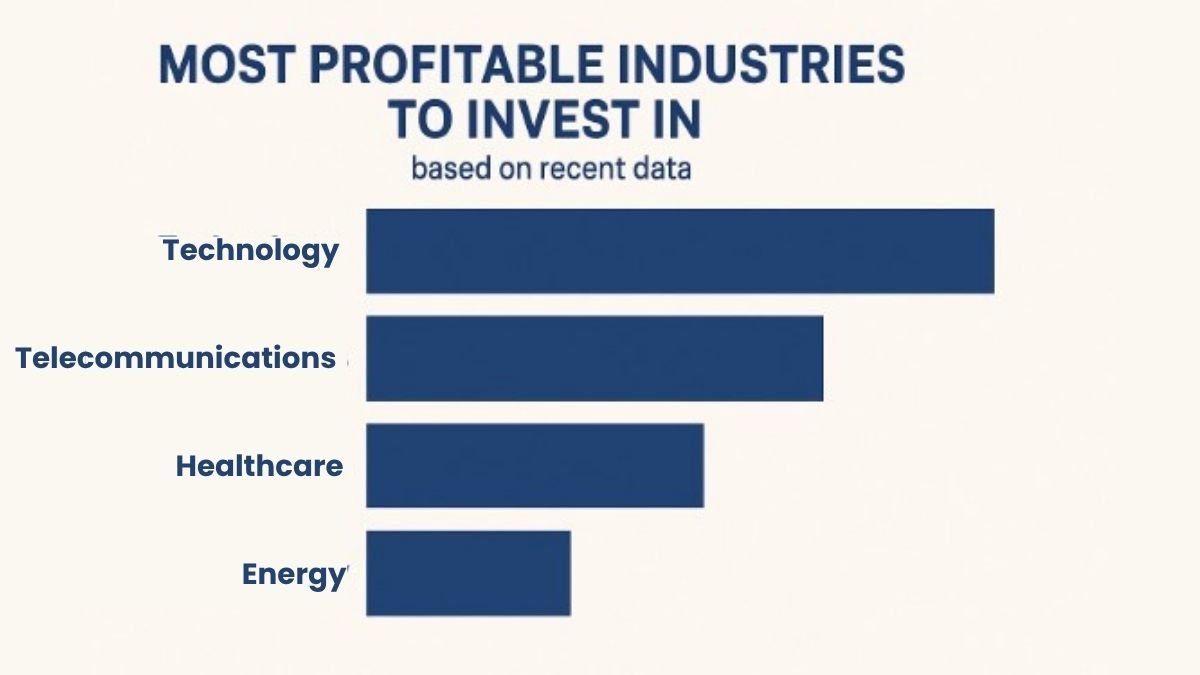

Most Profitable Industries in Canada (2025)

| Industry | Key Opportunities | Considerations |

|---|---|---|

| Real Estate | Residential & Commercial Properties | High Capital Investment |

| Technology & Software Development | SaaS, AI, Cybersecurity | Rapid Innovation Cycles |

| Healthcare Services | Clinics, Dental, Physiotherapy | Strict Regulatory Environment |

| E-commerce & Online Retail | Established Online Stores | Logistics & Digital Marketing |

| Franchise Opportunities | Food Services, Fitness Centers | Franchise Fees & Brand Standards |

If you’re unsure whether it’s better to buy a business or start one, this guide helps you weigh the pros and cons.

Top Industries to Consider in Canada

1. Real Estate and Property Management

This is one of the best businesses to buy in Canada. With urban centers like Toronto and Vancouver experiencing steady growth, real estate remains a lucrative sector. Opportunities abound in residential, commercial, and vacation rental properties. However, high capital investment and regulatory requirements should be considered.

2. Technology and Software Development

Canada’s tech sector is booming, especially in cities like Toronto and Vancouver. Acquiring SaaS platforms, cybersecurity firms, and AI startups can be profitable. The need for a skilled workforce and rapid innovation cycles are key considerations.

3. Healthcare Services

An aging population drives demand for medical services. Opportunities exist in primary care clinics, dental practices, and physiotherapy centers. Navigating the strict regulatory environment and licensing requirements is essential.

4. E-commerce and Online Retail

The growth of online shopping continues across Canada. Established online stores with loyal customer bases present acquisition opportunities. Managing logistics and digital marketing strategies are crucial for success.

5. Franchise Opportunities

Proven business models with brand recognition offer a pathway to ownership. Sectors like food services, fitness centers, and retail franchises are prominent. Adhering to franchise fees and brand standards is necessary.

Low-Cost and Emerging Opportunities

- Service-Based Ventures: Businesses like cleaning services, mobile pet grooming, and event planning require minimal startup capital and have growing demand.

- Digital-First Businesses: Online fitness coaching, affiliate marketing, and social media management are scalable with low overhead costs.

- Niche and Tech-Forward Models: Innovations in quantum computing, AI applications, and vertical farming are emerging fields with high growth potential.

Regional Factors and Market Drivers

Ontario | A Financial Hub with Diverse Industries

Ontario is a dominant economic force in Canada, offering a wide array of opportunities for business acquisition. As the country’s financial hub, it houses a vibrant finance industry, with Toronto being a key global financial center. The province also thrives in technology and manufacturing sectors, with cities like Ottawa and Waterloo serving as technology innovation hotspots.

Ontario’s diverse economy provides an abundance of industries to explore, including IT, finance, automotive, and healthcare. The favorable business environment, combined with strong infrastructure and access to a skilled workforce, makes Ontario an ideal region for those seeking to buy an established business.

Related post: What do I need to start a consulting business?

British Columbia | Thriving Tech and Tourism Sectors

British Columbia, home to the bustling city of Vancouver, has become a hotspot for tech and tourism. With a focus on clean technology, biotechnology, and digital innovation, BC’s economy continues to grow rapidly. Vancouver stands out as a tech hub with an increasing number of tech startups and established firms. The tourism sector, driven by the province’s natural beauty and vibrant culture, also offers a wealth of opportunities in hospitality, travel services, and leisure-related businesses.

For those looking to buy a business in Canada, British Columbia presents a unique combination of innovation and natural resources, making it an attractive region for investment.

Quebec | Strong Cultural and Industrial Presence

Quebec has a rich cultural heritage combined with a robust industrial base. The province is known for its aerospace industry, with Montreal being home to major global players like Bombardier and Pratt & Whitney. In addition to aerospace, Quebec also has a thriving pharmaceutical sector, with multiple companies focused on research and development. The tourism industry is another strong pillar, benefiting from the province’s historical charm, vibrant cities, and cultural attractions

Quebec’s unique bilingual nature and diverse economy offer business buyers opportunities in various sectors, including technology, manufacturing, and service-based industries.

Alberta | Resource-Rich Province with a Growing Economy

Alberta is a resource-rich province, well-known for its vast oil sands, which are a key contributor to the energy sector. In addition to energy, Alberta’s economy is diversified, with strong agricultural and technological sectors. Calgary and Edmonton are at the forefront of the province’s growth, with companies focusing on energy, agriculture, and technology.

Alberta’s business-friendly environment, low taxes, and abundant natural resources make it an ideal location for business acquisitions, especially for those looking to enter the energy or agricultural industries. The growing technology sector in Alberta offers innovative business opportunities in software, IT, and clean tech industries.

Step-by-Step Buying Process in Canada

Finding Deals

To begin the business acquisition process in Canada, it’s crucial to identify potential deals. Utilize brokers, online marketplaces, and industry networks to find businesses that match your investment goals. Websites like the Businesses for Sale (BFS) platform provide a comprehensive listing of over 2,650 businesses across various industries. Connecting with industry experts, such as M&A advisors and business brokers, can also help uncover hidden opportunities.

If you’re new to acquisitions, check out our detailed guide on how to legally buy a business to walk through each stage from deal sourcing to integration.

Due Diligence

Once you’ve identified a potential acquisition target, conducting thorough due diligence is essential. This process involves financial audits, legal reviews, and operational assessments to evaluate the health of the business. By examining financial records, tax filings, employee contracts, and customer data, you can determine the business’s financial stability and uncover any potential risks. It’s vital to work closely with legal and financial experts during this phase to ensure no crucial details are overlooked.

During due diligence, consider tax implications, such as learning whether I will get a tax refund if my business loses money. If you’re a sole proprietor or closely-held corporation.

Valuation Strategies

Determining the fair value of a business is critical to making an informed decision. Several valuation strategies are available, including asset-based, income-based, and market-based approaches. The asset-based method focuses on the business’s tangible and intangible assets, while the income-based method estimates future earnings potential. The market-based approach compares the business with similar companies to determine its value. Combining these methods provides a more comprehensive picture of the business’s worth.

Financing Acquisition

Financing the purchase of a business can involve several options. Bank loans, private investors, and government grants are common sources of capital. Mezzanine financing and vendor financing, where the seller provides a loan to the buyer, are also viable options. Exploring various financing routes allows you to choose the option that best suits your financial position and the acquisition’s terms.

Legal Structures

When buying a business in Canada, you must decide between an asset purchase or a share purchase. An asset purchase involves acquiring specific assets, such as equipment, inventory, and intellectual property, without assuming liabilities. In contrast, a share purchase involves acquiring the business’s shares, including all liabilities and obligations. Each option has different tax implications and legal considerations, so it’s essential to consult with legal experts to choose the right structure for your acquisition.

Risks, Challenges & Pitfalls

- Integration and Cultural Fit: After the acquisition, aligning company cultures and integrating operations can present significant challenges. Misalignment between the acquiring company’s values and the acquired company’s culture can lead to employee dissatisfaction and reduced productivity. Establishing a clear communication plan and understanding the cultural dynamics within the organization is crucial for a smooth transition.

- Financing Hurdles: Securing financing for a business acquisition can be complicated. Approximately 67% of acquisitions face financial hurdles, such as difficulty obtaining loans or investor backing. It’s essential to have a robust business plan and financial projections to attract lenders and investors. Additionally, unexpected expenses during the due diligence phase can delay the acquisition process.

- Market Saturation: Entering an oversaturated market can limit growth potential and profitability. Before making a purchase, it’s crucial to assess the level of competition in the target industry. Identifying market trends, consumer demands, and unmet needs will allow you to determine whether the business has room to grow in a competitive environment.

- Regulatory Barriers: Certain industries in Canada, such as cannabis and senior care, face stringent regulatory requirements. Understanding the legal and compliance landscape before purchasing a business in these sectors is essential to avoid costly mistakes. Ensuring that the business complies with all federal and provincial regulations will help mitigate any future legal risks.

Maximizing Your Investment

Value Creation Post-Acquisition

After acquiring a business, the next step is to create value. Implement strategies to improve operations, streamline processes, and enhance customer experiences. By optimizing workflows and investing in technology upgrades, you can increase efficiency and profitability. Additionally, improving the brand’s visibility through targeted marketing campaigns can lead to higher customer retention and acquisition rates.

Expansion Pathways

To maximize your investment, consider various expansion pathways. Franchising, acquiring complementary businesses, or integrating technology can help scale operations quickly. Expanding into new markets or diversifying product offerings can also lead to significant growth. By evaluating your business’s strengths and opportunities, you can create a plan to drive long-term success.

Exit Strategies

An exit strategy is essential for realizing the returns on your investment. Whether through resale, an initial public offering (IPO), or succession planning, having a clear exit plan will allow you to capitalize on the business’s value. Establishing milestones and timelines for the exit strategy can ensure that you are prepared to make the most of your investment.

Case Studies & Key Stats

- HVAC Acquisition: A strategic acquisition in the HVAC sector resulted in a 30% increase in market share within two years. By enhancing service delivery and expanding the customer base, the acquired business quickly became more profitable.

- Logistics Growth: Investing in a logistics company led to a 25% reduction in delivery times and a 15% increase in customer satisfaction. The company implemented technological upgrades to optimize operations and improve delivery efficiency.

- Wellness Centre Success: Acquiring a wellness center led to a 40% growth in clientele through enhanced services and targeted marketing efforts. By focusing on customer satisfaction and expanding service offerings, the business saw significant revenue growth.

- Canada’s GDP Breakdown: In 2023, Canada’s GDP reached $2.14 trillion, with significant contributions from industries such as real estate, manufacturing, and mining. These sectors continue to be a driving force behind the country’s economic growth and present numerous opportunities for business acquisitions.

Final Thoughts

Acquiring a business in Canada offers numerous opportunities across various sectors. By conducting thorough due diligence, understanding regional dynamics, and implementing effective strategies post-acquisition, investors can maximize their returns and ensure long-term success. Whether you’re venturing into real estate, technology, healthcare, or emerging industries, Canada presents a fertile ground for business growth and profitability.

If you’re ready to explore business acquisition opportunities in Canada, start by identifying industries that align with your expertise and investment capacity. Engage with brokers, conduct thorough due diligence, and seek professional advice to navigate the acquisition process successfully. Canada’s diverse economy offers a wealth of opportunities for strategic investors.

FAQs | Best Businesses to Buy in Canada

What are the most profitable businesses to buy in Canada?

The most profitable businesses in Canada include real estate, technology startups, healthcare services, and e-commerce, with opportunities in emerging sectors like AI and clean tech.

How do I finance a business acquisition in Canada?

Business acquisitions in Canada can be financed through bank loans, private investors, government grants, mezzanine financing, or vendor financing, depending on the deal structure.

What are the legal requirements for buying a business in Canada?

Legal requirements include conducting due diligence, complying with provincial and federal regulations, obtaining necessary licenses and permits, and ensuring the correct business structure (asset or share purchase).

How can I assess the value of a business before purchasing?

To assess a business’s value, analyze its financial health, market position, and growth potential using methods like asset-based valuation, income-based valuation, or market comparisons.

Are there government incentives for business acquisitions in Canada?

Yes, Canada offers various government incentives, such as tax benefits, grants, and financing programs, especially for acquisitions in sectors like clean technology, healthcare, and manufacturing.